good health, good friends, and

Saturday, December 31, 2022

HAPPY NEW YEAR

good health, good friends, and

Wednesday, December 21, 2022

What To Expect from the Housing Market in 2023

Article Courtesy of Keeping Current Matters/The KCM Blog

The 2022 housing market has been defined by two key things: inflation and rapidly rising mortgage rates. And in many ways, it’s put the market into a reset position.

As the Federal Reserve (the Fed) made moves this year to try to lower inflation, mortgage rates more than doubled – something that’s never happened before in a calendar year. This had a cascading impact on buyer activity, the balance between supply and demand, and ultimately home prices. And as all those things changed, some buyers and sellers put their plans on hold and decided to wait until the market felt a bit more predictable.But what does that mean for next year? What everyone really wants is more stability in the market in 2023. For that to happen we’ll need to see the Fed bring inflation down even more and keep it there. Here’s what housing market experts say we can expect next year.

What’s Ahead for Mortgage Rates in 2023?

Moving forward, experts agree it’s still going to be all about inflation. If inflation is high, mortgage rates will be as well. But if inflation continues to fall, mortgage rates will likely respond. While there may be early signs inflation is easing as we round out this year, we’re not out of the woods just yet. Inflation is still something to watch in 2023.

Right now, experts are factoring all of this into their mortgage rate forecasts for next year. And if we average those forecasts together, experts say we can expect rates to stabilize a bit more in 2023. Whether that’s between 5.5% and 6.5%, it’s hard for experts to say exactly where they’ll land. But based on the average of their projections, a more predictable rate is likely ahead (see chart below):

That means, we’ll start the year out about where we are right now. But we could see rates tick down if inflation continues to drop. As Greg McBride, Chief Financial Analyst at Bankrate, explains:

“. . . mortgage rates could pull back meaningfully next year if inflation pressures ease.”

In the meantime, expect some volatility as rates will likely fluctuate in the weeks ahead. If we see inflation come back under control, that would be good news for the housing market.

What Will Happen to Home Prices Next Year?

Homes prices will always be defined by supply and demand. The more buyers and fewer homes there are on the market, the more home prices will rise. And that’s exactly what we saw during the pandemic.

But this year, things changed. We’ve seen home prices moderate and housing supply grow as buyer demand pulled back due to higher mortgage rates. The level of moderation has varied by local area – with the biggest changes happening in overheated markets. But do experts think that will continue?

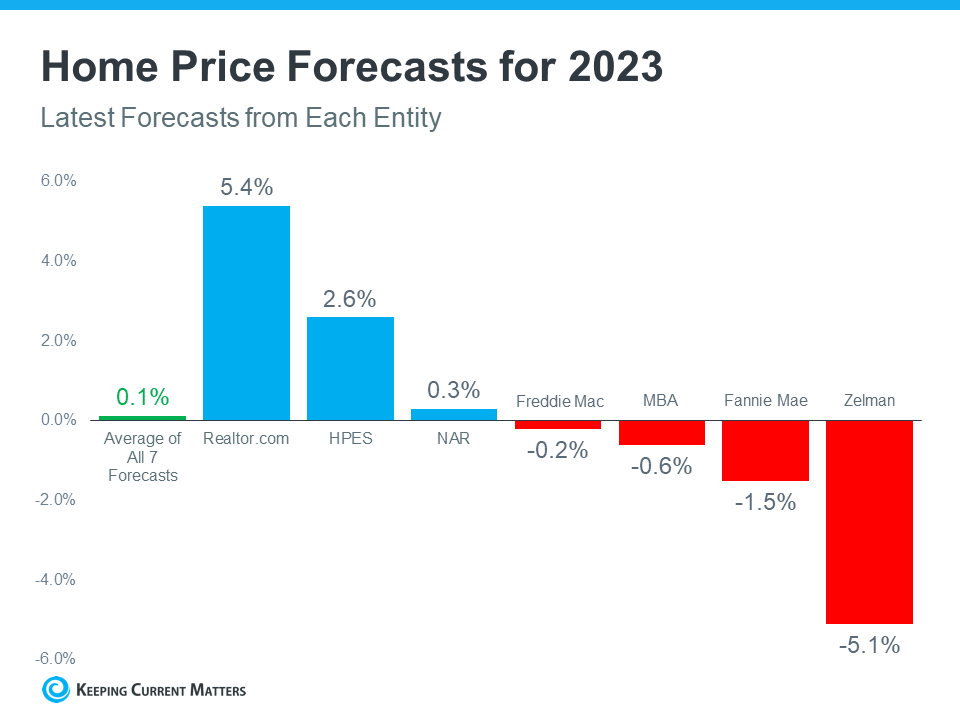

The graph below shows the latest home price forecasts for 2023. As the different colored bars indicate, some experts are saying home prices will appreciate next year, and others are saying home prices will come down. But again, if we take the average of all the forecasts (shown in green), we can get a feel for what 2023 may hold.

The truth is probably somewhere in the middle. That means nationally, we’ll likely see relatively flat or neutral appreciation in 2023. As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“After a big boom over the past two years, there will essentially be no change nationally . . . Half of the country may experience small price gains, while the other half may see slight price declines.”

Bottom Line

The 2023 housing market is going to be defined by mortgage rates, and rates will be determined by what happens with inflation. The best way to keep a pulse on what experts are projecting for next year is to lean on a trusted real estate advisor.

Monday, December 12, 2022

What Every Seller Should Know About Home Prices

Article Courtesy of Keeping Current Matters / The KCM Blog

If you’re trying to decide whether or not to sell your house, recent headlines about home prices may be top of mind. And if those stories have you wondering what that means for your home’s value, here’s what you really need to know.What’s Really Happening with Home Prices?

It’s possible you’ve seen news stories mentioning a drop in home values or home price depreciation, but it’s important to remember those headlines are designed to make a big impression in just a few words. But what headlines aren’t always great at is painting the full picture.

While home prices are down slightly month-over-month in some markets, it’s also true that home values are up nationally on a year-over-year basis. The graph below uses the latest data from S&P Case-Shiller to help tell the story of what’s actually happening in the housing market today:

As the graph shows, it’s true home price growth has moderated in recent months (shown in green) as buyer demand has pulled back in response to higher mortgage rates. This is what the headlines are drawing attention to today.

But what’s important to notice is the bigger, longer-term picture. While home price growth is moderating month-over-month, the percent of appreciation year-over-year is still well above the home price change we saw during more normal years in the market.

The bars for January 2019 through mid-2020 show home price appreciation around 3-4% a year was more typical (see bars for January 2019 through mid-2020). But even the latest data for this year shows prices have still climbed by roughly 10% over last year.

What Does This Mean for Your Home’s Equity?

While you may not be able to capitalize on the 20% appreciation we saw in early 2022, in most markets your home’s value, on average, is up 10% over last year – and a 10% gain is still dramatic compared to a more normal level of appreciation (3-4%).

The big takeaway? Don’t let the headlines get in the way of your plans to sell. Over the past two years alone, you’ve likely gained a substantial amount of equity in your home as home prices climbed. Even though home price moderation will vary by market moving forward, you can still use the boost your equity got to help power your move.

As Mark Fleming, Chief Economist at First American, says:

“Potential home sellers gained significant amounts of equity over the pandemic, so even as affordability-constrained buyer demand spurs price declines in some markets, potential sellers are unlikely to lose all that they have gained.”

Bottom Line

If you have questions about home prices or how much equity you have in your current home, reach out to a local real estate professional for expert advice.

Wednesday, December 7, 2022

Key Advantages of Buying a Home Today

Article Courtesy of Keeping Current Matters / The KCM Blog

There’s no doubt buying a home today is different than it was over the past couple of years, and the shift in the market has led to advantages for buyers today. Right now, there are specific reasons that make this housing market attractive for those who’ve thought about buying but have sidelined their search due to rising mortgage rates.Buying a home in any market is a personal decision, and the best way to make that decision is to educate yourself on the facts, not following sensationalized headlines in the news today. The reality is, headlines do more to terrify people thinking about buying a home than they do to clarify what’s actually going on with real estate.

Here are three reasons potential home buyers should consider buying a home today.

1. More Homes Are for Sale Right Now

According to data from the National Association of Realtors (NAR), this year, the supply of homes for sale has grown significantly compared to where we started the year (see graph below):

This growth has happened for two reasons: homeowners listing their homes for sale and homes staying on the market a bit longer as buyer demand has moderated in response to higher mortgage rates.

The good news for you is that more inventory means more homes to choose from. And when there are more homes on the market, you could also see less competition from other buyers because the peak frenzy of competing over the same home has eased too.

2. Home Prices Are Not Projected To Crash

Experts don’t believe home prices will crash like they did in 2008. Instead, home prices will moderate at various levels depending on the local market and the factors, like supply and demand, at play in that area. That’s why some experts are calling for slight appreciation and others are calling for slight depreciation (see graph below):

3. Mortgage Rates Have Risen, but They Will Come Down

While mortgage rates have risen dramatically this year, the rapid increases we’ve seen have moderated in recent weeks as early signs hint that inflation may be easing slightly. Where they’ll go from here largely depends on what happens next with inflation. If inflation does truly begin to cool, mortgage rates may come down as a result.

When that happens, expect more buyers to jump back into the market. For you, that means you’ll once again face more competition. Buying your house now before more buyers reenter the market could help you get one step ahead. As Lawrence Yun, Chief Economist for NAR, says:

“The upcoming months should see a return of buyers, as mortgage rates appear to have already peaked and have been coming down since mid-November.”

When mortgage rates come down, those waiting on the sidelines will jump back in. Your advantage is getting in before they do.

Bottom Line

If you’re thinking about buying a home, you should seriously consider the advantages today’s market offers. Connecting with a local real estate professional may be the best next move so you can make the dream of homeownership a reality.

Monday, December 5, 2022

Prioritizing Your Wants and Needs as a Homebuyer in Today’s Market

Article Courtesy of Keeping Current Matters / The KCM Blog

There’s no denying mortgage rates are higher now than they were last year. And if you’re thinking about buying a home, this may be top of mind for you. That’s because those higher rates impact how much it costs to borrow money for your home loan. As you set out to make a purchase this winter, you’ll need to be strategic so you can find a home that meets your needs and budget.Danielle Hale, Chief Economist at realtor.com, explains:

“The key to making a good decision in this challenging housing market is to be laser focused on what you need now and in the years ahead, . . . Another key point is to avoid stretching your budget, as tempting as it may be given the diminished purchasing power.”

In other words, it’s important to be mindful of what’s a necessity and what’s a nice-to-have when searching for a home. And the best way to understand this is to put together a list of desired features for your home search.

The first step? Get pre-approved for a mortgage. Pre-approval helps you better understand what you can borrow for your home loan, and that plays an important role in how you’ll craft your list. After all, you don’t want to fall in love with a home that’s out of reach. Once you have a good grasp of your budget, you can begin to list (and prioritize) all the features of a home you would like.

Here’s a great way to think about them before you begin:

- Must-Haves – If a house doesn’t have these features, it won’t work for you and your lifestyle (examples: distance from work or loved ones, number of bedrooms/bathrooms, etc.).

- Nice-To-Haves – These are features that you’d love to have but can live without. Nice-To-Haves aren’t dealbreakers, but if you find a home that hits all the must-haves and some of the these, it’s a contender (examples: a second home office, a garage, etc.).

- Dream State – This is where you can really think big. Again, these aren’t features you’ll need, but if you find a home in your budget that has all the must-haves, most of the nice-to-haves, and any of these, it’s a clear winner (examples: farmhouse sink, multiple walk-in closets, etc.).

Finally, once you’ve created your list and categorized it in a way that works for you, discuss it with your real estate advisor. They’ll be able to help you refine the list further, coach you through the best way to stick to it, and find a home in your area that meets your needs.

Bottom Line

Putting together your list of necessary features for your next home might seem like a small task, but it’s a crucial first step on your homebuying journey today. If you’re ready to find a home that fits your needs, connect with a local real estate advisor.

Saturday, December 3, 2022

Winter Home Selling Checklist [INFOGRAPHIC]

Infographic Courtesy of Keeping Current Matters/The KCM Blog

Some Highlights

- As you get ready to sell your house, focus on tasks that make it inviting, show it’s cared for, and boost your curb appeal.

- This list will help you get started, but don’t forget, a real estate professional will provide other helpful tips based on your specific situation.

- Connect with a trusted real estate professional for advice on what you may want to do to get your house ready to sell this season.

Thursday, November 24, 2022

Monday, November 21, 2022

Mortgage Rates Will Come Down, It’s Just a Matter of Time

Article Courtesy of Keeping Current Matters / The KCM Blog

This past year, rising mortgage rates have slowed the red-hot housing market. Over the past nine months, we’ve seen fewer homes sold than the previous month as home price growth has slowed. All of this is due to the fact that the average 30-year fixed mortgage rate has doubled this year, severely limiting homebuying power for consumers. And, this month, the average rate for financing a home briefly rose over 7% before coming back down into the high 6% range. But we’re starting to see a hint of what mortgage interest rates could look like next year.

Inflation Is the Enemy of Long-Term Interest Rates

As long as inflation is high, we’ll see higher mortgage rates. Over the past couple of weeks, we’ve seen indications that inflation may be cooling, giving us a glimpse into what may happen in the future. The mortgage market is eagerly awaiting positive news on inflation. As Ali Wolf, Chief Economist at Zonda, says:

“The housing market is expected to face continued uncertainty heading into 2023 as consumers, financial markets, and policymakers work through their respective challenges in today’s economy. . . . we are watching for any additional stability in the MBS market, signs of cooling inflation, and/or less aggressive Federal Reserve action to give us confidence that mortgage rates are past their peak.”

What Does This Mean for the Future of Mortgage Rates?

As we get through the inflation battle and start to see that coming down, we should expect mortgage rates to follow. We’ve seen nods of this over the past couple of weeks. As the Federal Reserve works to bring inflation down, mortgage rates will come down as well. Bill McBride from Calculated Risk says:

“My current view is inflation will ease quicker than the Fed currently expects.”

As we look toward next year, we certainly hope he’s right.

Bottom Line

Mortgage rates will come down – it’s just a matter of time. The hope is we continue to see more positive news on inflation, and that’ll bring mortgage rates down. This will give prospective homebuyers more buying power and lead to more homeowners throughout the country.

Friday, November 11, 2022

Veterans Day 2022 - We Honor Those Who Served

|

| Beautiful tribute to our Veterans by Richard Kerry Thompson. YOU RAISE ME UP |

| ||

| A lovely rendition of HALLELUJAH by Sailor Jerri to honor our veterans. |

Thursday, November 10, 2022

HAPPY 247TH BIRTHDAY TO THE UNITED STATES MARINE CORPS

SEMPER FI

|

| My husband and his Basic School brothers gathered at the Vietnam Wall. |

Each year it is my honor and privilege to offer birthday greetings and a heartfelt thank you to my husband and his special Marine Corps brothers and to all who wear or have worn the globe and anchor. Once a Marine, always a Marine. The Few. The Proud. Semper Fi.

Source: http://www.usmcpress.com/heritage/usmc_heritage.htm

Since those earliest days when the "Continental Marines" fought for our country's independence at sea and on shore, the United States Marine Corps has responded to conflicts around the world, participating in combat operations and humanitarian relief efforts by air, land, and sea. Mandated by Congress to be our county's rapid response force, the United State Marine Corps has proudly served our country for 247 years. From the shores of Tripoli to Guadalcanal and Iwo Jima, Korea, the jungles of Vietnam, the mountains of Afghanistan, the Iraqi desert, and all the operations in-between, Marines from all walks of life have defended our nation.

On November 10th, Marines around the world live up to the motto "Semper Fidelis" (Always Faithful) as they celebrate the birth of the Corps. Whether attending a formal Marine Corps Ball or a small informal gathering, or even with just a phone call or a handshake, those who share the bond of being one of "The Few. The Proud." proudly honor the values, traditions, and history of the Corps on this day by wishing each other a Happy Birthday.

To donate, please visit: SemperFiFund.org/match

Friday, October 28, 2022

Applying for a Mortgage Doesn’t Have To Be Scary [INFOGRAPHIC]

Infographic Courtesy of Keeping Current Matters/The KCM Blog

Some Highlights

- Even with higher mortgage rates, the mortgage process doesn’t need to be something you fear. Here are some steps to help as you set out to buy a home.

- Know your credit score and work to build strong credit. When you’re ready, lean on the pros and connect with a lender so you can get pre-approved and begin your home search.

- Any major life change can be scary, and buying a home is no different. Partner with a trusted real estate professional to take fear out of the equation.

Friday, October 21, 2022

3 Questions You May Be Asking About Selling Your House Today [INFOGRAPHIC]

Infographic Courtesy of Keeping Matters / The KCM Blog

Remember that this information is generalized and not specific to this area. Scroll down to see the actual month's inventory at the end of September for SCCL Single Family Residences and Carriage Homes and Villas.

Some Highlights

- If you’re planning to sell your house this year, you likely have questions about what the shift in the housing market means for your home sale.

- You might be wondering: Should I wait to sell? Are buyers still out there? And can I afford to buy my next home?

- Connect with a trusted real estate professional so you can get answers to these questions and learn about the opportunities you still have in today’s housing market.

SHOULD YOU WAIT TO SELL?

CHECK OUT THESE LOCAL STATS:

Thursday, October 20, 2022

What’s Ahead for Home Prices?

Article Courtesy of Keeping Current Matters / The KCM Blog

As the housing market cools in response to the dramatic rise in mortgage rates, home price appreciation is cooling as well. And if you’re following along with headlines in the media, you’re probably seeing a wide range of opinions calling for everything from falling home prices to ongoing appreciation. But what’s true? What’s most likely to happen moving forward?While opinions differ, the most likely outcome is we’ll fall somewhere in the middle of slight appreciation and slight depreciation. Here’s a look at the latest expert projections so you have the best information possible today.

What the Experts Are Saying About Home Prices Next Year

The graph below shows the most up-to-date forecasts from five experts in the housing industry. These are the experts that have most recently updated their projections based on current market trends:

As the graph shows, the three blue bars represent experts calling for ongoing home price appreciation, just at a more moderate rate than recent years. The red bars on the graph are experts calling for home price depreciation.

While there isn’t a clear consensus, if you take the average (shown in green) of all five of these forecasts, the most likely outcome is, nationally, home price appreciation will be fairly flat next year.

What Does This Mean?

Basically, experts are divided on what’s ahead for 2023. Home prices will likely depreciate slightly in some markets and will continue to gain ground in others. It all depends on the conditions in your local market, like how overheated that market was in recent years, current inventory levels, buyer demand, and more.

The good news is home prices are expected to return to more normal levels of appreciation rather quickly. The latest forecast from Wells Fargo shows that, while they feel prices will fall in 2023, they think prices will recover and net positive in 2024. That forecast calls for 3.1% appreciation in 2024, which is a number much more in line with the long-term average of 4% annual appreciation.

And the Home Price Expectation Survey (HPES) from Pulsenomics, a poll of over one hundred industry experts, also calls for ongoing appreciation of roughly 2.6 to 4% from 2024-2026. This goes to show, even if prices decline slightly next year, it’s not expected to be a lasting trend.

As Jason Lewris, Co-Founder and Chief Data Officer for Parcl, says:

“In the absence of trustworthy, up-to-date information, real estate decisions are increasingly being driven by fear, uncertainty, and doubt.”

Don’t let fear or uncertainty change your plans. If you’re unsure about where prices are headed or how to make sense of what’s going on in today’s housing market, reach out to a local real estate professional for the guidance you need each step of the way.

Bottom Line

The housing market is shifting, and it’s a confusing place right now. The best way to navigate that shift is to lean on a trusted real estate professional to help you make confident and informed decisions about what’s happening in your market.

Tuesday, October 18, 2022

The Latest on Supply and Demand in Housing

Article Courtesy of Keeping Current Matters / The KCM Blog

Over the past two years, the substantial imbalance of low housing supply and high buyer demand pushed home sales and buyer competition to new heights. But this year, things are shifting as supply and demand reach an inflection point.The graph below helps tell the story of just how different things are today.

This year, buyer demand has eased as higher mortgage rates and mounting economic uncertainty moderated the market. This slowdown in demand is clear when you look at the red bar on the graph. It uses the latest data from ShowingTime to illustrate how showings (an indicator of buyer demand) have softened by just over 12% compared to the same time last year.

Now for a look at how housing supply has changed, turn to the green bar. It uses data from realtor.com to show active listings are up nearly 27% compared to last year. That’s because the moderation of demand allowed housing inventory to increase in 2022.

What Does This Inflection Point Mean for Buyers?

If you’re thinking of buying a home, you’ll have less competition and more options than you would have had last year. Enjoy having more homes to choose from in your home search and lean on a trusted real estate professional to understand how the increase in supply has also increased your negotiation power. That professional can talk you through the opportunities and challenges buyers face in today’s shifting market. You may be surprised to find they’re different than they were a year ago.

What Does This Inflection Point Mean for Sellers?

If you’re looking to sell your house, know that inventory is still low overall. That means, if you work with an agent to price your house based on current market value, it will still sell despite the inventory gains and moderating buyer demand this year. That’s because there are still buyers out there who want to move, and your house may be exactly what they’re looking for.

Bottom Line

If you’re thinking of buying or selling a home, the best place to turn to for information on today’s supply and demand is a trusted real estate professional. They’ll be able to explain what’s happening in your local market and what that means for you.

Thursday, October 13, 2022

Perspective Matters When Selling Your House Today

Article Courtesy of Keeping Current Matters/The KCM Blog

Does the latest news about the housing market have you questioning your plans to sell your house? If so, perspective is key. Here are some of the ways a trusted real estate professional can explain the shift that’s happening today and why it’s still a sellers’ market even during the cooldown.Fewer Homes for Sale than Pre-Pandemic

While the supply of homes available for sale has increased this year compared to last, we’re still nowhere near what’s considered a balanced market. A recent article from Calculated Risk helps put this year’s increased inventory into context (see graph below):

It shows supply this year has surpassed 2021 levels by over 30%. But the further back you look, the more you’ll understand the big picture. Compared to 2020, we’re just barely above the level of inventory we saw then. And if you go all the way back to 2019, the last normal year in real estate, we’re roughly 40% below the housing supply we had at that time.Why does this matter to you? When inventory is low, there is still demand for your house because there just aren’t enough homes available for sale.

Homes Are Still Selling Faster Than More Normal Years

And while homes aren’t selling as quickly as they did a few months ago, the average number of days on the market is still well below pre-pandemic norms – in large part because inventory is so low. The graph below uses data from the Realtors’ Confidence Index by the National Association of Realtors (NAR) to illustrate this trend:

As the graph shows, the pre-pandemic numbers (shown in blue) are higher than the numbers we saw during the pandemic (shown in green). That’s because the average days on the market started to decrease as homes sold at record pace during the pandemic. Most recently, due to the cooldown in the housing market, the average days on the market have started to tick back up slightly (shown in orange) but are still far below the pre-pandemic norm.

What does this mean for you? While it may not be as fast as it was a couple of months ago, homes are still selling much faster than they did in more normal, pre-pandemic years. And if you price it right, your home could still go under contract quickly.

Buyer Demand Has Moderated and Is Now in Line with More Typical Years

Buyer demand has softened this year in response to rising mortgage rates. But again, perspective is key. Getting 3-5 offers like sellers did during the pandemic isn’t the norm. The graph below uses data from NAR going back to 2018 to help tell the story of this shift over time (see graph below):

Prior to the pandemic, it was typical for homes sold to see roughly 2-2.5 offers (shown in blue). As the market heated up during the pandemic, the average number of offers skyrocketed as record-low mortgage rates drove up demand (shown in green). But most recently, the number of offers on homes sold today (shown in orange) has started to return to pre-pandemic levels as the market cools from the frenzy.

What’s the takeaway for you? Buyer demand has moderated from the pandemic peak, but it hasn’t disappeared. The buyers are still out there, and if you price your house at current market value, you’ll still be able sell your house today.

Bottom Line

If you have questions about selling your house in today’s housing market, talk to a trusted real estate professional. An agent can help provide context around what’s happening now, so you’re up to date on what you can expect when you’re ready to move.

Wednesday, October 12, 2022

Article Courtesy of Keeping Current Matters / The KCM Blog

If you’re looking to buy a home, you probably want to secure the lowest interest rate possible for your home loan. Over the last couple of years, that was easier to do as the housing market saw record-low mortgage rates, but this year rates have risen dramatically.If you’re looking for ways to combat today’s higher rates and lock in the lowest one you can, here are a few factors to focus on. Since approval opportunities can vary, connect with a trusted lender for customized advice.

Your Credit Score

Credit scores can play a big role in your mortgage rate. Freddie Mac explains:

“When you build and maintain strong credit, mortgage lenders have greater confidence when qualifying you for a mortgage because they see that you’ve paid back your loans as agreed and used your credit wisely. Strong credit also means your lender is more apt to approve you for a mortgage that has more favorable terms and a lower interest rate.”

That’s why it’s important to maintain a good credit score. If you want to focus on improving your score, your trusted advisor can give you expert advice to help.

Your Loan Type

There are many types of loans, each offering different terms for qualified buyers. The Consumer Financial Protection Bureau (CFPB) says:

“There are several broad categories of mortgage loans, such as conventional, FHA, USDA, and VA loans. Lenders decide which products to offer, and loan types have different eligibility requirements. Rates can be significantly different depending on what loan type you choose.”

When working with your real estate advisor, make sure you find out what’s available in your area and which types of loans you may qualify for.

Your Loan Term

Another factor to consider is the term of your loan. Just like with location and loan types, you have options. Freddie Mac says:

“When choosing the right home loan for you, it’s important to consider the loan term, which is the length of time it will take you to repay your loan before you fully own your home. Your loan term will affect your interest rate, monthly payment, and the total amount of interest you will pay over the life of the loan.”

Depending on your situation, the length of your loan can also change your mortgage rate.

Your Down Payment

If you’re a current homeowner looking to sell and make a move, you can use the home equity you’ve built over time toward the down payment on your next home. The CFPB explains:

“In general, a larger down payment means a lower interest rate, because lenders see a lower level of risk when you have more stake in the property. So if you can comfortably put 20 percent or more down, do it—you’ll usually get a lower interest rate.”

To learn more, connect with a lender to find out the difference a higher down payment can make for your new mortgage.

Bottom Line

These are just few factors that can help determine your mortgage rate if you’re buying a home. The best thing you can do is have a team of professionals on your side. Connect with a local real estate professional and a trusted lender so you have the expert advice you need in each step of the process.

Monday, September 26, 2022

The True Strength of Homeowners Today

Article Courtesy of Keeping Current Matters/The KCM Blog

The real estate market is on just about everyone’s mind these days. That’s because the unsustainable market of the past two years is behind us, and the difference is being felt. The question now is, just how financially strong are homeowners throughout the country? Mortgage debt grew beyond 10 trillion dollars over the past year, and many called that a troubling sign when it happened for the first time in history.Recently Odeta Kushi, Deputy Chief Economist at First American, answered that question when she said:

“U.S. households own $41 trillion in owner-occupied real estate, just over $12 trillion in debt, and the remaining ~$29 trillion in equity. The national “LTV” in Q2 2022 was 29.5%, the lowest since 1983.”

She continued on to say:

“Homeowners had an average of $320,000 in inflation-adjusted equity in their homes in Q2 2022, an all-time high.”

What Is LTV?

The term LTV refers to loan to value ratio. For more context, here’s how the Mortgage Reports defines it:

“Your ‘loan to value ratio’ (LTV) compares the size of your mortgage loan to the value of the home. For example: If your home is worth $200,000, and you have a mortgage for $180,000, your LTV ratio is 90% — because the loan makes up 90% of the total price.

You can also think about LTV in terms of your down payment. If you put 20% down, that means you’re borrowing 80% of the home’s value. So your LTV ratio is 80%.”

Why Is This Important?

This is yet another reason we won’t see the housing market crash. Home equity allows homeowners to be in control. For example, if someone did need to sell their home, they likely have the equity they need to be able to sell it and still put money in their pocket. This was not the case back in 2008, when many owed more on their homes than they were worth.

Bottom Line

Homeowners today have more financial strength than they have had since 1983. This is a combination of how homeowners have handled equity since the crash and rising home prices of the last two years. And this is yet another reason homeownership in any market makes sense.

Friday, September 16, 2022

A Crucial First Step: Mortgage Pre-Approval [INFOGRAPHIC]

Infographic Courtesy of Keeping Current Matter/The KCM Blog

Some Highlights

- Mortgage pre-approval means a lender has reviewed your finances and, based on factors like your income, debt, and credit history, determined how much you’re qualified to borrow.

- Being pre-approved for a loan can give you clarity while planning your homebuying budget, confidence in your ability to secure a loan, and helps sellers know your offer is serious.

- Connect with a trusted professional to learn more and start your homebuying process today.

Wednesday, September 14, 2022

Is the Real Estate Market Slowing Down, or Is This a Housing Bubble?

Article Courtesy of Keeping Current Matters/The KCM Blog

The talk of a housing bubble in the coming year seems to be at a fever pitch as rising mortgage rates continue to slow down an overheated real estate market. Over the past two years, home prices have appreciated at an unsustainable pace causing many to ask: are things just slowing down, or is a crash coming?To answer this question, there are two things we want to understand. The first is the reality of the shift in today’s housing market. And the second is what experts are saying about home prices in the coming year.

The Reality of the Shift in Today’s Housing Market

The reality is we’re seeing an inflection point in housing supply and demand. According to realtor.com, active listings have increased more than 26% over last year, while showings from the latest ShowingTime Showing Index have decreased almost 17% from last year (see graph below). This is an inflection point for housing because, over the past two years, we’ve seen a massive amount of demand (showings) and not enough homes available for sale for the number of people that wanted to buy. That caused the market frenzy.

Today, supply and demand look very different, and the market is slowing down from the pace we’ve seen. This offers proof of the sudden slowdown so many people are feeling.

What Experts Are Saying About Home Prices in the Coming Year

Right now, most experts are forecasting home price appreciation in 2023, but at a much slower pace than the last two years. The average of the six forecasters below is for national home prices to appreciate by 2.5% in the coming year. Only one of the six is calling for home price depreciation.

When we look at the shift taking place along with what experts are saying, we can conclude the national real estate market is slowing down but is not a bubble getting ready to burst. This isn’t to say that a few overheated markets won’t experience home price depreciation, but there isn’t a case to be made for a national housing bubble.

Bottom Line

The real estate market is slowing down, and that’s causing many to fear we’re in a housing bubble. What we’ve experienced in the housing market over the past two years were historic levels of demand and constrained supply. That led to homes going up in value at a record pace. While some overheated markets may experience price depreciation in the short term, according to experts, the national real estate market will appreciate in the coming year.

![A Crucial First Step: Mortgage Pre-Approval [INFOGRAPHIC] | Keeping Current Matters](https://files.keepingcurrentmatters.com/wp-content/uploads/2022/09/15090145/20220916-NM.png)