This information is updated regularly.

Please use the "UP-TO-DATE STATS FOR SCCL" tab above for current information.

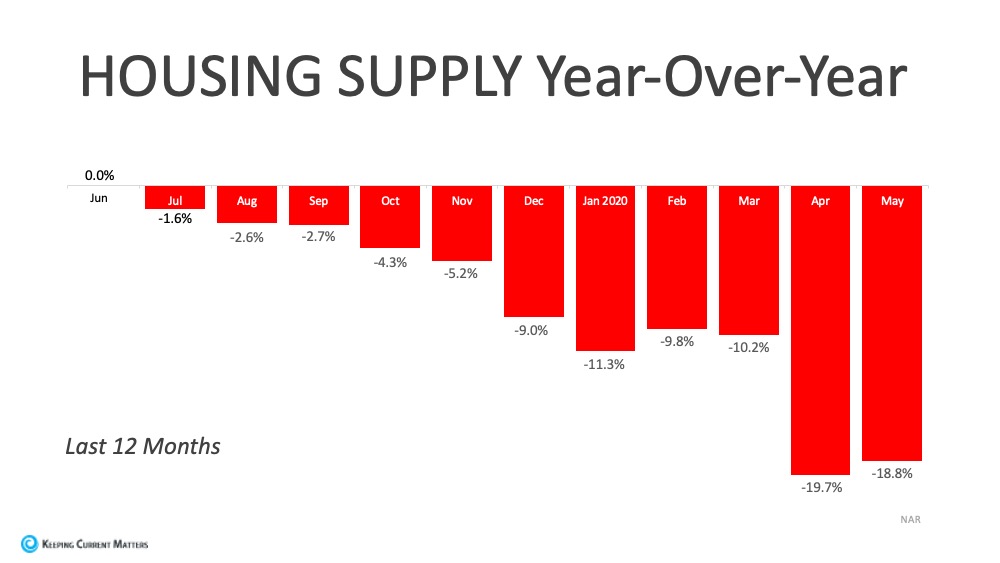

The number of ACTIVE listings here in SCCL continues to fall. There are likely a variety of reasons that there are so few listings at this time, with the most likely being COVID-19 concerns. Some people may not want anyone coming through their home and they may not want to look at homes themselves. Know that these are valid concerns and everyone's personal choices should be respected. Know, also, that there are ways to handle these concerns with careful attention to everyone's safety. Virtual tours are one option that some people are choosing right now. For those who are willing to allow showings, they are handled with careful attention to CDC guidelines. If you are considering selling, please contact me to talk about your options.

Below is data showing all currently ACTIVE, UNDER CONTRACT, and CLOSED properties for the current month. Similar information can be found for data since January 1st by clicking on the "CURRENTLY ACTIVE/UNDER CONTRACT/CLOSED YTD" tab above.

Single Family Residences (SFR)

|

| Click to enlarge. |

Carriage Homes and Villas

|

| Click to enlarge. |

DDP = Due Diligence Period

UCS = Under Contract Show / UCNS = Under Contract No Show

DOM = Days on Market

BR = Bedrooms

BA = Bathrooms

HLA = Heated Living Area (Square Footage)

Price/SF = Price Per Square Foot

UC Date = Under Contract Date

----------------------------------------------------------

Be sure to scroll down for recent articles about the housing market. Remember that the number of postings on a page is limited, so to see earlier postings you'll need to click on "Older Posts" on the bottom right of each page.

![Mortgage Rates Fall Below 3% [INFOGRAPHIC] | Keeping Current Matters](https://files.keepingcurrentmatters.com/wp-content/uploads/2020/07/16175337/20200717-NM.jpg)