Sound decisions can only be made with accurate and reliable information.

Monday, December 25, 2023

JUST LISTED - BEAUTIFUL MUIRFIELD VILLA

MERRY CHRISTMAS!

Monday, December 4, 2023

Experts Project Home Prices Will Rise over the Next 5 Years

Article Courtesy of Keeping Current Matters/The KCM Blog

Even with so much data showing home prices are actually rising in most of the country, there are still a lot of people who worry there will be another price crash in the immediate future. In fact, a recent survey from Fannie Mae shows that 23% of consumers think prices will fall over the next 12 months. That’s nearly one in four people who are dealing with that fear – maybe you’re one of them.To help ease that concern, here’s what the experts say will happen with home prices not just next year, but over the next five years.

Experts Project Ongoing Appreciation

While seeing a small handful of expert opinions may not be enough to change your mind, hopefully, a larger group of experts will reassure you. Here’s that larger group.

The Home Price Expectation Survey (HPES) from Pulsenomics is

a great resource to show what experts

forecast for home prices over a

five-year period. It includes projections from over 100 economists,

investment strategists, and housing market analysts. And the results

from the latest quarterly release show home prices are expected to go up

every year through 2027 (see graph below):

And while the projected increase in 2024 isn’t as large as 2023, remember home price appreciation is cumulative. In other words, if these experts are correct after your home’s value rises by 3.32% this year, it should go up by another 2.17% next year.

If you’re worried home prices are going to fall, here’s the big takeaway. Even though prices vary by local area, experts project they’ll continue to rise across the country for years to come at a pace that’s more normal for the market.

What Does This Mean for You?

If you’re not convinced yet, maybe these numbers will get your attention. They show how a typical home’s value could change over the next few years using the expert projections from the HPES. Check out the graph below:

In this example, let’s say you bought a $400,000 home at the beginning of this year. If you factor in the forecast from the HPES, you could potentially accumulate more than $71,000 in household wealth over the next five years.Bottom Line

If you’re someone who’s worried home prices are going to fall, rest assured a lot of experts say it’s just the opposite – nationally, home prices will continue to climb not just next year, but for years to come. If you have any questions or concerns about what’s next for home prices in your local area, connect with a real estate agent.

Friday, December 1, 2023

Preventing Frozen Pipes

Information Courtesy of Christa McMillan, CISR

Personal Risk Consultant at Main Street Insurance

How to Prevent Frozen Pipes

Frozen pipes can present an invisible threat – one that you might not recognize until the weather starts to warm. By then, the water damage can be significant and costly. Fortunately, keeping your home warmer, at a consistent temperature, and better insulated can help protect your pipes from freezing this winter.

What Do You Do if You Have a Frozen Pipe?

If you suspect pipes in your home have been exposed to freezing temperatures, or

water is not flowing through a faucet normally, follow these steps to help reduce the

potential for water damage:

- Locate and close the main water shutoff valve as soon as possible and before temperatures rise above freezing.

- Open all faucets including those outside to drain remaining water from pipes.

- Have buckets, towels and fans available to contain, clean-up and dry water leaks.

- Slowly turn water back on and inspect for leaks. If there are leaks, be prepared to turn the water off immediately.

- Also inspect pipes for damage in areas like attics and crawl spaces, where it is safe to do so.

- Never use torches or heat guns to facilitate thawing as these can create fire hazards.

- As temperatures increase above freezing, watch and listen for signs of water leaks.

- If there is pipe damage, call a licensed plumber for repairs.

Why is a Frozen Pipe a Concern?

When water begins to freeze, it expands. This can cause both plastic and metal pipes to burst, possibly leading to significant water damage to your home.

- Since water expands when it freezes, it puts unwanted pressure on pipes.

- As water freezes, the force exerted from the expansion can cause a pipe to burst, regardless of the strength of the material.

- You may not know you have a burst pipe as the water has turned to ice. Once the temperature starts to warm and thawing begins, leaking and flooding can occur.

Which Pipes Are Most at Risk?

Pipes that are most exposed to the elements, including those outdoors and along the

exterior walls of your home, may need extra protection during winter months. These

include the following:

- Outdoor hose hookups and faucets.

- Swimming pool supply lines.

- Lawn sprinkler lines.

- Water pipes in unheated, interior locations such as basements, crawl spaces, attics, garages and kitchen and bathroom cabinets.

- Pipes running against exterior walls with little or no insulation.

How to Help Prevent Frozen Pipes

Before winter:

- Check your home for areas where water pipes are located in unheated or poorly insulated areas. Be sure to check your basement, attic, crawl space, garage and within cabinets containing plumbing. Hot and cold water pipes should both be insulated.

- Products such as pipe sleeves or UL-listed heat tape or heat cable can help insulate or heat exposed water pipes.

During winter:

- Close inside valves supplying water to outdoor faucets and hookups.

- Open outdoor faucets to allow residual water to drain; be sure to keep them open during the cold weather months, while the water supply is turned off.

- Keep garage doors closed to help protect water pipes located in the garage.

- Open the doors on cabinets where plumbing is located. This can help allow warmer air to circulate around the pipes.

- For pipes that are at risk of freezing (both hot and cold water pipes), let water drip from faucets.

- Keep the heat in your home set at a minimum of 55 degrees.

Thursday, November 23, 2023

HAPPY THANKSGIVING!

Wednesday, November 22, 2023

Home Prices Still Growing – Just at a More Normal Pace

Article Courtesy of Keeping Current Matters / The KCM Blog

If you’re feeling a bit muddy on what’s happening with home prices, that’s no surprise. Some people are still saying prices are falling, even though data proves otherwise. Part of that misconception is because people are getting their information from unreliable sources. But it’s also coming from some media coverage misrepresenting what the data really shows.So, to keep things simple, here’s what you really need to know using real data you can trust.

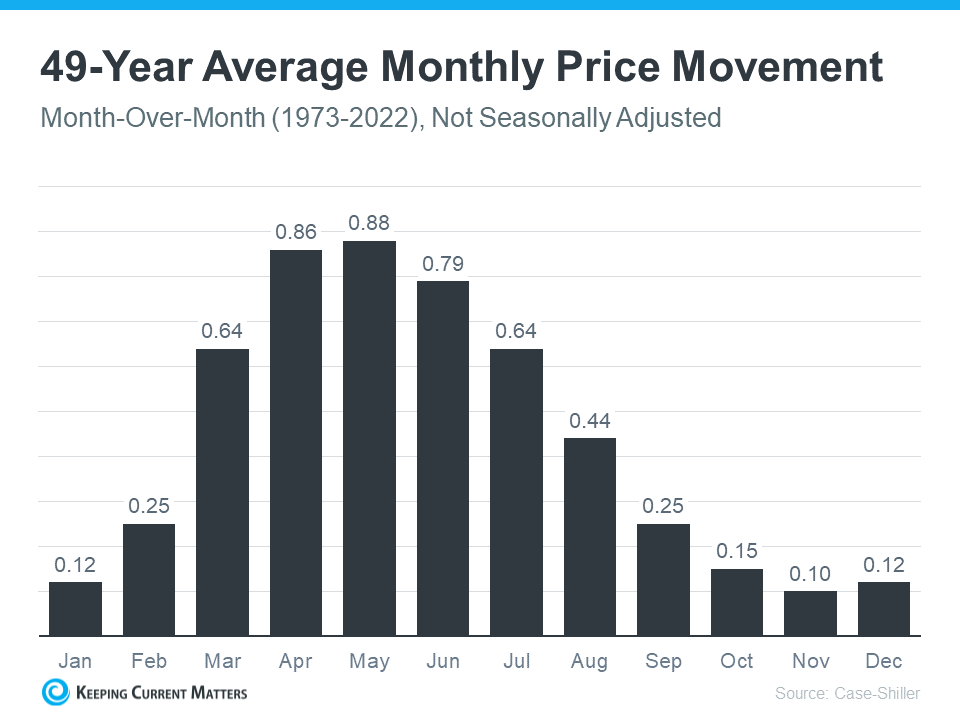

Normal Home Price Seasonality Explained

In the housing market, there are predictable ebbs and flows that happen each year. It’s called seasonality. Spring is the peak homebuying season when the market is most active. That activity is typically still strong in the summer but begins to wane as the cooler months approach.

Home prices follow along with seasonality because prices appreciate most when something is in high demand. That’s why there’s a reliable long-term home price trend. The graph below uses data from Case-Shiller to show the typical percent change for monthly home price movement from 1973 through 2022 (not adjusted, so you can see the seasonality):

As the data shows, at the beginning of the year, home prices grow, but not as much as they do when entering the spring and summer markets. That’s because the market is less active in January and February since fewer people move in the cooler months. As the market transitions into the peak homebuying season in the spring, activity ramps up, and home prices go up a lot more in response. Then, as fall and winter approach, prices still grow, just at a slower pace as activity eases again.

This Year, Seasonality Has Returned

Now, let’s look at how this year compares to that long-term trend (see graph below):

In a nutshell, nationally prices aren’t falling, it’s just that price growth is beginning to normalize. Moving forward, there’s a chance the media will misrepresent this slowing of home price growth as prices falling. So don’t believe everything you see in the headlines. The data included here gives you the context you need to really understand what’s happening. So, if you see something in the headlines that’s confusing, don’t just take it at face value. Ask a trusted real estate professional for more information.

Remember, it’s normal to see home price growth slow down as the year goes on. And that definitely doesn’t mean home prices are falling. They’re just rising at a more moderate pace.

Bottom Line

Home price appreciation is returning to normal seasonality and that’s a good thing. If you have questions about what’s happening with prices in your local area, connect with a real estate professional.

Monday, November 20, 2023

Is Your House the Top Thing on a Buyer’s Wish List this Holiday Season?

- As noted in #1 below, people who are looking at homes right now are typically serious buyers, as there's too much else going on for folks to check out homes if they're not considering a move.

- At this time of year, many folks who live in colder areas of the country are visiting friends or family here. The thought of moving can be pretty appealing when it's snowing and really cold back home.

- Many homeowners who consider moving to active adult communities have lived in their current homes for a long time and have built up a large amount of equity. This could allow them to put down a large down payment if applying for a loan or to pay cash for a home. In a posting I made last month, ARE THERE MORE CASH OR LOAN SALES IN SCCL AND TREE TOPS?, I noted that, at that time, just over half of the last 100 homes sold in SCCL were cash sales. At that same time, cash sales at TreeTops accounted for just under half of the last 100 sales. Higher interest rates may not be as much of concern to folks with equity in their current home.

This

time every year, homeowners who are planning to move have a decision to

make: sell now or wait until after the holidays? Some sellers with

homes already on the market may even remove their listing until the new

year.

This

time every year, homeowners who are planning to move have a decision to

make: sell now or wait until after the holidays? Some sellers with

homes already on the market may even remove their listing until the new

year.But the truth is, many buyers want to purchase a home for the holidays, and your house might be just what they’re looking for. As an article from Fortune Builders explains:

“ . . . while a majority of people take a step back from the real estate market during the holiday months, you may find when the temperature drops, your potential for a great real estate deal starts to rise.”

To help prove that point, here are four reasons you shouldn’t wait to sell your house.

1. The desire to own a home doesn’t stop during the holidays. While a few buyers might opt to delay their moving plans until January, others may need to move now because something in their life has changed. The buyers who look for homes at this time of year are usually motivated to make their move happen and are eager to buy. A recent article from Investopedia says:

“Anyone shopping for a new home between Thanksgiving and New Year’s is likely going to be a serious buyer. Putting your home on the market at this time of year and attracting a serious buyer can often result in a quicker sale.”

2. While the supply of homes for sale has increased a little bit lately, overall inventory is still lower than it was before the pandemic. What does that mean for you? If you work with an agent to price your house at market value, it could still sell quickly because today’s buyers are craving more options – and your home may be exactly what they’re searching for.

3. You can determine the days and times that are most convenient for you for home showings. That can help you minimize disruptions to your own schedule, which can be especially important during this busy time of year. Plus, you may find buyers are more flexible on when they’ll tour a house this time of year because they have more time off from work around the holidays.

4. And finally, homes decorated for the holidays appeal to many buyers. For those buyers, it’s easy to picture gathering with their loved ones in the home and making memories of their own. An article on selling at this time of year offers this advice:

“If you’re selling around a holiday and have decorations up, make sure they accent—not overpower—a room. Less is more.”

Bottom Line

Friday, November 17, 2023

2024 Housing Market Forecast [INFOGRAPHIC]

Infographic Courtesy of Keeping Current Matters/The KCM Blog

Some Highlights

- Thinking of buying or selling a house and wondering what the new year holds for the housing market? Experts forecast home prices to end this year up 2.8% and to rise another 1.5% in 2024. And climbing prices help make homeownership a good investment.

- Plus, home sales are projected to increase in 2024. That’s good news because it means experts are forecasting more activity as people continue to move.

Friday, November 10, 2023

VA Loans Help Heroes Achieve Homeownership

Some Highlights

- VA home loans can help people who served our country become homeowners.

- These loans can help qualified individuals purchase a VA-approved home or condo, build a new home, or enhance their current one.

- Owning a home is the American Dream, and one way to show our appreciation to veterans is by providing them with important information about the advantages of VA home loans.

Here are some important things to know about VA loans before you buy a home.

The Many Advantages of VA Home Loans

VA home loans provide a pathway to homeownership for those who have served our nation, and they’re a great benefit for buyers who qualify. According to the Department of Veteran Affairs:

- Options for No Down Payment: Qualified borrowers can often purchase a home with no down payment. That’s a huge weight lifted when you’re trying to save for a home.

- Limited Closing Costs: There are limits on the types of closing costs you pay when you qualify for a VA home loan. So, more money stays in your pocket when it’s time to seal the deal.

- Don’t Require Private Mortgage Insurance (PMI): Many other loans with down payments under 20% require PMI. VA loans do not, which means veterans can save on their monthly housing costs.

A recent article from Veterans United sums up just how impactful this loan option can be:

“For the vast majority of military borrowers, VA loans represent the most powerful lending program on the market. These flexible, $0-down payment mortgages have helped more than 24 million service members become homeowners since 1944.”

Bottom Line

Owning a home is the American Dream. Veterans sacrifice a lot to protect our country, and one way we can show our appreciation is by making sure they know all the benefits of VA home loans. Thank you for your service.

Veterans Day 2023 - We Honor Those Who Served

|

| Beautiful tribute to our Veterans by Richard Kerry Thompson. YOU RAISE ME UP |

HAPPY 248TH BIRTHDAY TO THE UNITED STATES MARINE CORPS

SEMPER FI

|

| My husband and his Basic School brothers gathered at the Vietnam Wall. |

Each year it is my honor and privilege to offer birthday greetings and a heartfelt thank you to my husband and his special Marine Corps brothers and to all who wear or have worn the globe and anchor. Once a Marine, always a Marine. The Few. The Proud. Semper Fi.

Source: http://www.usmcpress.com/heritage/usmc_heritage.htm

Since those earliest days when the "Continental Marines" fought for our country's independence at sea and on shore, the United States Marine Corps has responded to conflicts around the world, participating in combat operations and humanitarian relief efforts by air, land, and sea. Mandated by Congress to be our county's rapid response force, the United State Marine Corps has proudly served our country for 248 years. From the shores of Tripoli to Guadalcanal and Iwo Jima, Korea, the jungles of Vietnam, the mountains of Afghanistan, the Iraqi desert, and all the operations in-between, Marines from all walks of life have defended our nation.

On November 10th, Marines around the world live up to the motto "Semper Fidelis" (Always Faithful) as they celebrate the birth of the Corps. Whether attending a formal Marine Corps Ball or a small informal gathering, or even with just a phone call or a handshake, those who share the bond of being one of "The Few. The Proud." proudly honor the values, traditions, and history of the Corps on this day by wishing each other a Happy Birthday.

To donate, please visit: SemperFiFund.org/match

Monday, November 6, 2023

Reasons To Sell Your House Before the New Year

Article Courtesy of Keeping Current Matters/The KCM Blog

Get One Step Ahead of Other Sellers

Typically, in the residential real estate market, homeowners are less likely to list their houses toward the end of the year. That’s because people get busy around the holidays and sometimes deprioritize selling their house until the start of the new year when their schedules and social calendars calm down. But that gives you an opportunity to get one step ahead.

Selling now, while other homeowners may hold off until after the holidays, can help you get a leg up on your competition. Start the process with a real estate agent today so you can get your house on the market before your neighbors do.

Get Your House in Front of Eager Buyers

Even though the supply of homes for sale did grow compared to last year, it’s still low. That means there aren’t enough homes on the market today. While some buyers may also delay their plans to move until January, others will still need to move for personal reasons or because something in their life has changed.

Those buyers are still going to be active later this year and will be seriously motivated to make their move happen because they need to. Unfortunately, the challenge they’ll face is a shortage of available inventory to meet their needs. A recent article from Investopedia says:

“. . . if your house is up for sale in the winter and someone is looking at it, chances are that person is serious and ready to buy. Anyone shopping for a new home between Thanksgiving and New Year’s is likely going to be a serious buyer. Putting your home on the market at this time of year and attracting a serious buyer can often result in a quicker sale.”

Use Your Equity To Fuel Your Move

Keep in mind that homeowners today have record amounts of equity. According to CoreLogic, the average amount of equity per mortgage holder has climbed to almost $290,000. That means the equity you have in your house right now could cover some, if not all, of a down payment on the home of your dreams.

And as you weigh the reasons to sell before year-end, it’s important to remember the reasons that sparked your desire to move in the first place. Maybe it’s time for a new home in a location that suits you better, one that offers the perfect space for you and your loved ones, or maybe your needs have evolved over time. A local real estate agent can help you determine how much home equity you have and how you can use it to achieve your goal of making a move.

Bottom Line

Listing your home before the new year can offer unique benefits. Less competition, motivated buyers, and your equity gains can all play to your advantage. Reach out to a local real estate agent to achieve your goals before winter sets in.

Friday, October 13, 2023

The Importance of Pricing a Home Right - Data Updated 10/25/23

In my October 12 posting, FIRST HOME SELLS FOR OVER $1,000,000 IN SCCL, I said that "some (folks) are now listing higher than current comps would suggest is appropriate, and are having to reduce their asking price." As a follow-up to that, I want to share some data on recent price reductions.

The information below was updated on 10/25/23.

SCCL Single Family Residences (SFRs)

Thursday, October 12, 2023

ARE THERE MORE CASH OR LOAN SALES IN SCCL AND TREE TOPS?

FIRST HOME SELLS FOR OVER $1,000,000 IN SCCL

The first home to be listed for over $1M in SCCL has become the first home to sell for over $1M. The home, a Cumberland Hall with a beautifully finished basement, sunroom, patio, large screened porch, and a lovely golf course view, listed for $1,296,000 on August 3rd and went under contract two days later. It closed on October 12th for $1,175,000.

Growing Your Net Worth with Homeownership

Article Courtesy of Keeping Current Matters/The KCM Blog

Take a moment to imagine where you want to be in a few years. You might be thinking about your job, money, wanting more stability, or goals you want to reach soon. Is homeownership a part of that vision? If it is, you should know owning a home has a whole lot of financial benefits.One of the many reasons to buy a home is that it’s a great way to build wealth and gain financial stability. That’s because the value of most homes increases over time, which in turn grows your net worth. Here’s how home values are rising right now. According to Zillow:

“The total value of the U.S. housing market – the sum of Zillow’s estimated value for every U.S. home – is now slightly less than $52 trillion, which is $1.1 trillion higher than the previous peak reached last June.”

Basically, homeownership is a tremendous wealth-building tool. And with home values back on the rise across the nation, now might be a good time to consider if owning a home is something you want to reach for.

Here’s a look at some data to see how much owning a home can really make a difference in your life.

Household Net Worth Is Rising

Data shows that while those in the top 1% saw the most dramatic net worth increase, people from every single tax bracket have seen their wealth grow over the past few years (see graph below):

For many of those people, the rising value of their home plays a big part in that.

Owning a Home Helps You Achieve Financial Success

You can tell homeownership had a lot to do with that growth because there’s a significant net worth gap between homeowners and renters. As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“. . . homeownership is a catalyst for building wealth for people from all walks of life. A monthly mortgage payment is often considered a forced savings account that helps homeowners build a net worth about 40 times higher than that of a renter.”

The big reason why? Homeowner’s build equity. Home equity is the value of your home minus the amount you owe on your mortgage. And for most homeowners, that’s the largest contributor to their net worth. Here’s the data from First American to prove it (see graph below):

The blue portion of each bar represents housing as a portion of net worth – and it’s clearly a bigger contributor than other investments like stocks, gold, and cryptocurrencies. As you can see, across different income levels, homeownership does more to build the average household’s wealth than anything else.

Bottom Line

One of the biggest benefits of owning a home is that it can provide an avenue to grow your net worth.Monday, October 9, 2023

Key Skills You Need Your Listing Agent To Have

Selling

your house is a big decision. And that can make it feel both exciting

and a little bit nerve-wracking. But the key to a successful sale is

finding the perfect listing agent to work with you throughout the

process. A listing agent, also known as a seller’s agent, helps market and sell your house while advocating for you every step of the way.

Selling

your house is a big decision. And that can make it feel both exciting

and a little bit nerve-wracking. But the key to a successful sale is

finding the perfect listing agent to work with you throughout the

process. A listing agent, also known as a seller’s agent, helps market and sell your house while advocating for you every step of the way. But, how do you know you’ve found the perfect match in an agent? Here are three key skills you’ll want your listing agent to have.

They Price Your House Based on the Latest Data

While it may be tempting to pick the agent who suggests the highest asking price for your house, that strategy may cost you. It’s easy to get caught up in the excitement when you see a bigger number, but overpricing your house can have consequences. It could mean it’ll sit on the market longer because the higher price is actually deterring buyers.

Instead, you want to pick an agent who’s going to have an open conversation about how they think you should price your house and why. A great agent will base their pricing strategy on solid data. They won’t throw out a number just to win your listing. Instead, they’ll show you the facts, explain their pricing strategy, and make sure you’re on the same page. As NerdWallet explains:

“An agent who recommends the highest price isn’t always the best choice. Choose an agent who backs up the recommendation with market knowledge.”

They’re a Great Negotiator

The home-selling process can be emotional, especially if you’ve been in your house for a long time. You’re connected to it and have a lot of memories there. This can make the negotiation process harder. That’s where a trusted professional comes in.

A skilled listing agent will be calm under pressure and will be your point-person in all of those conversations. Their experience in handling the back-and-forth gives you with the peace of mind that you’ve got someone on your side who’s got your best interests in mind throughout this journey.

They’re a Skilled Problem Solver

At the heart of it all, a listing agent’s main priority is to get your house sold. A great agent never loses sight of that goal and will help you prioritize your needs above all else. If they identify any necessary steps you need to take, they’ll be open with you about it. Their commitment to your success means they’ll work with you to address any potential roadblocks and find creative solutions to anything that pops up along the way.

BankRate explains it like this:

“Just as important as the knowledge and experience agents bring is their ability to guide you smoothly through the process. Above all, go with an agent you trust and will feel comfortable with. . .”

Bottom Line

Whether you're a first-time seller or you’ve been through selling a house before, a great listing agent is the key to success. Connect with a real estate professional so you have a skilled local expert by your side to guide you through every step of the process.

Monday, September 25, 2023

Beginning with Pre-Approval

Article Courtesy of Keeping Current Matters/The KCM Blog

If you’re looking to buy a home this fall, there are a few things you need to know. Affordability is tight with today’s mortgage rates and rising home prices. At the same time, there’s a limited number of homes on the market right now and that’s creating some competition among buyers. But, if you’re strategic, there are ways to navigate these waters. The first thing you’ll want to do is get pre-approved for a mortgage. That way you’ll know your numbers and can set yourself up for success from the start of your home search.What Pre-Approval Does for You

To understand why it’s such an important step, you need to know what pre-approval is. As part of the homebuying process, a lender looks at your finances to determine what they’d be willing to loan you. From there, your lender will give you a pre-approval letter to help you know how much money you can borrow. Freddie Mac explains it like this:

“A pre-approval is an indication from your lender that they are willing to lend you a certain amount of money to buy your future home. . . . Keep in mind that the loan amount in the pre-approval letter is the lender’s maximum offer. Ultimately, you should only borrow an amount you are comfortable repaying.”

Basically, pre-approval gives you critical information about the homebuying process that’ll help you understand how much you may be able to borrow. Why does this help you, especially today? With higher mortgage rates and home prices impacting affordability for many buyers right now, a solid understanding of your numbers is even more important so you can truly wrap your head around your options.

Pre-Approval Helps Show Sellers You’re a Serious Buyer

Let’s face it, there are more buyers looking to buy than there are homes available for sale and that imbalance is creating some competition among homebuyers. That means you could see yourself in a multiple-offer scenario when you make an offer on a home. But getting pre-approved for a mortgage can help you stand out from other hopeful buyers.

As an article from Wall Street Journal (WSJ) says:

“If you plan to use a mortgage for your home purchase, preapproval should be among the first steps in your search process. Not only can getting preapproved help you zero in on the right price range, but it can give you a leg up on other buyers, too.”

Pre-approval shows the seller you’re a serious buyer that’s already undergone a credit and financial check, making it more likely that the sale will move forward without unexpected delays or financial issues.

Bottom Line

Getting pre-approved is an important first step when you’re buying a home. The more prepared you are, the better chance you have of getting the home you want. Connect with a trusted lender so you have the tools you need to purchase a home in today’s market.

Monday, September 11, 2023

Planning to Retire? Your Equity Can Help You Make a Move

Article Courtesy of Keeping Current Matters/The KCM Blog

Reaching retirement is a significant milestone in life, bringing with it a lot of change and new opportunities. As the door to this exciting chapter opens, one thing you may be considering is selling your house and finding a home better suited for your evolving needs.Fortunately, you may be in a better position to make a move than you realize. Here are a few reasons why.

Consider How Long You’ve Been in Your Home

From 1985 to 2009, the average length of time homeowners stayed in their homes was roughly six years. But according to the National Association of Realtors (NAR), that number is higher today. Since 2010, the average home tenure is just over nine years (see graph below):

This means many homeowners have been living in their houses even longer in recent years. When you live in a home for such a significant amount of time, it’s natural for you to experience changes in your life while you’re in that house. As those life changes and milestones happen, your needs may change. And if your current home no longer meets them, you may have better options waiting for you.

Consider the Equity You’ve Gained

And, if you’ve been in your home for more than a few years, you’ve likely built-up substantial equity that can fuel your next move. That’s because you gain equity as you pay down your loan and as home prices appreciate. And, the longer you’ve been in your home, the more you may have gained. Data from the Federal Housing Finance Agency (FHFA) illustrates that point (see graph below):

While home prices vary by area, the national average shows the typical homeowner who’s been in their house for five years saw it increase in value by nearly 60%. And the average homeowner who’s owned their home for 30 years saw it almost triple in value over that time.

Whether you’re looking to downsize, relocate to a dream destination, or move so you live closer to friends or loved ones, that equity can help. Whatever your home goals are, a trusted real estate agent can work with you to find the best option. They’ll help you sell your current house and guide you as you buy the home that’s right for you and your lifestyle today.

Bottom Line

As you plan for your retirement, connect with a local real estate agent to find out how much equity you’ve built up over the years and plan how you can use it toward the purchase of a home that fits your changing needs.