Sound decisions can only be made with accurate and reliable information.

Friday, October 30, 2020

Monday, October 26, 2020

Two Important Impacts of Home Equity

Article Courtesy of Keeping Current Matters/The KCM Blog

Equity continues to rise, helping American homeowners secure a much more stable financial future. According to the most recent data from CoreLogic, the average homeowner gained $9,800 in equity over the past year. In addition, experts project 2020 home prices to continue rising. With prices going up, equity gains will also keep accelerating. Black Knight just reported:“The annual percent change in the overall median existing single-family-home price has skyrocketed in the past several months, with recent numbers at three to five times higher than rates seen in the past several years.”

Jeff Tucker, Senior Economist at Zillow, just qualified recent price increases as “jaw-dropping” and “within a hair’s breadth of double-digit year-over-year appreciation.”

Knowing equity will help enable many homeowners to better survive the economic distress caused by the ongoing pandemic, it’s important to break down two key homeowner benefits of increasing equity.

1. Equity Increases a Homeowner’s Options to Buy a New Home

Aside from the financial damage of the last seven months, there has also been a tremendous emotional toll on many people. Shelter-in-place mandates, quarantine requirements, and virtual schooling have all made us re-evaluate the must-have requirements a home should deliver. Having equity in your current house gives you a better opportunity to move-up or build your perfect home from scratch.

Mark Fleming, Chief Economist at First American, recently explained:

“As homeowners gain equity in their homes, they are more likely to consider using that equity to purchase a larger or more attractive home – the wealth effect of rising equity.”

If you need to make a move, the equity in your current home can help make that possible – right now.

2. Equity Enables Homeowners to Help Future Generations

An increase in home equity grows overall wealth, which can transfer to future generations. The Federal Reserve, in an addendum to their recent Survey of Consumer Finances, explains:

“There are numerous ways families can transmit wealth and resources across generations. Families can directly transfer their wealth to the next generation in the form of a bequest. They can also provide the next generation with inter vivos transfers (gifts), for example, providing down payment support to enable a home purchase or a substantial wedding gift.”

The Federal Reserve also explains another way wealth (including the additional net worth generated by an increase in home equity) can benefit future generations:

“In addition to direct transfers or gifts, families can make investments in their children that indirectly increase their wealth. For example, families can invest in their children’s educational success by paying for college or private schools, which can in turn increase their children’s ability to accumulate wealth.”

Bottom Line

Equity can help a homeowner grow their confidence in a more stable financial future. It provides near-term move-up options and creates a positive impact for future generations. In many cases, the largest single investment a person has is their home. As that investment appreciates in value, financial options increase too.

Tuesday, October 20, 2020

October Mid-Month Update

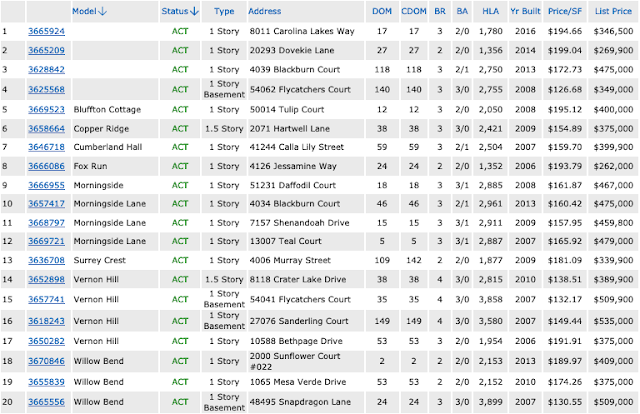

Activity in Sun City Carolina Lakes continues to be strong. As of today (10/19/2020) there are only 20 ACTIVE single family home listings and 6 Carriage Home/Villa listings. The numbers change daily and, as I've mentioned before, one of the main reasons I don't use flyers to share this information is that flyers are accurate at the time they are printed and are typically outdated by the time they reach mail tubes. I hope you'll visit my website regularly for the most current listing activity and the most current stats for SCCL. If you want to receive daily updates in your "inbox," just let me know and I'll make that happen for you.

Currently ACTIVE Listings

Single Family Residences

To date, 14 Single Family homes and one Villa have gone UNDER CONTRACT this month.

Check out the Days on Market (DOM) to see how many days it took for these properties to go under contract from the day they became ACTIVE listings. Note that CDOM indicates that a property was listed more than once and shows a total for both listings.

Friday, October 16, 2020

How to Prepare for a Bidding War [INFOGRAPHIC]

Infographic Courtesy of Keeping Current Matters / The KCM blog

Some Highlights

- With so few houses available on the market today, being ready for a bidding war is essential for prospective homebuyers.

- From pre-approval to making your best offer, here are three tips to make sure you can act quickly and confidently when you find the perfect home.

- Reach out to a trusted real estate professional today to be sure you have the guidance you need as the competition for homes heats up this season.

Wednesday, October 14, 2020

Record-High Lumber Costs Drive Up New-Home Prices

Shoppers seeking newly constructed homes are facing sharply increased prices as the cost of lumber has soared to record highs. Many buyers are finding themselves priced out of the new-home market, builders say.

Recent price spikes in lumber have added more than $16,000 to the typical cost of a new single-family home. The multifamily sector is also feeling the impact, with the typical apartment seeing an increase of more than $6,000, according to data from the National Association of Home Builders.

The increase has priced more than 2.1 million U.S. households out of the market for a median-priced new home, according to the NAHB.

Average lumber prices have increased by more than 170% since mid-April. They’ve reached a record high of more than $800 per 1,000 board feet, a common industry measure. Builders are advocating for lawmakers to take action to increase the supply and reduce the cost of lumber, saying lumber shortages could stress the housing market beyond its current state if too many buyers become priced out of the new-home market.

“Residential construction can lead the nation out of its current economic downturn, as it has during virtually every major economic disruption over the past five decades,” writes Chuck Fowke, NAHB’s 2020 chairman, in a column at BuilderOnline. “But it is vital that elected officials support policies that help America’s home builders gain access to reasonably priced building materials, particularly lumber.”

Thursday, October 8, 2020

Should You Buy a Retirement Home Sooner Rather than Later?

Article Courtesy of Keeping Current Matters/The KCM Blog

Every day in the U.S., roughly 10,000 people turn 65. Prior to the health crisis that swept the nation in 2020, most people had to wait until they retired to make a move to the beach, the golf course, or the senior living community they were looking to settle into for their later years in life. This year, however, the game changed.Many of today’s workers who are nearing the end of their professional careers, but maybe aren’t quite ready to retire, have a new choice to make: should I move before I retire? If the sand and sun are calling your name and you have the opportunity to work remotely for the foreseeable future, now may be a great time to purchase that beach bungalow you’ve always dreamed of or the single-story home in the sprawling countryside that might be a little further out of town. Whether it’s a second home or a future retirement home, spending the next few years in a place that truly makes you smile every day might be the best way to round out a long and meaningful career.

Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), explains:

“The pandemic was unexpected, working from home was unexpected, but nonetheless many companies realized that workers can be just as productive working from home…We may begin to see a boost in people buying retirement homes before their retirement.”

According to the 20th Annual Transamerica Retirement Survey, 3 out of 4 retirees (75%) own their homes, and only 23% have mortgage debt (including any equity loans or lines of credit). Since entering retirement, almost 4 in 10 retirees (38%) have moved into a new home. They’re making a profit by selling their current homes in today’s low inventory market and using their equity to purchase their future retirement homes. It’s a win-win.

Why These Homeowners Are Making Moves Now

The health crisis this year made us all more aware of the importance of our family and friends, and many of us have not seen our extended families since the pandemic started. It’s no surprise, therefore, to see in the same report that 32% of those surveyed cited the top reason they’re making a move is that they want to be closer to family and friends (See graph below):

If you’re one of the 73% of retirees with a single-family home and want to move closer to your family, now is the time to put your house on the market. With the pace homes are selling today, you could essentially wrap up your move – start to finish – before the holidays.

Bottom Line

Whether you’re looking to fully retire or to buy a second home with the intent to use it as your retirement home in the future, the 2020 fall housing market may very well work in your favor. Reach out to a local real estate professional today to learn more about the options in your local market.

Wednesday, October 7, 2020

Pumpkin Patches, Corn Mazes, and Haunted Trails Around the Carolinas

Article Courtesy of Helen Adams Realty / The HAR Blog

The Charlotte area is finally feeling those fall temperatures start to arrive, which means it’s time to check out pumpkin patches with friends and family. An October tradition for many people, there are countless pumpkin patches around the Carolinas with different tricks and treats to enjoy. October is typically the month that our temperatures and closets transition to those cooler temps, so bring on the fall festivities with these farms around town.

Aw Shucks! Corn Maze & Pumpkin Patch

Aw Shucks Corn Maze and Pumpkin Patch hosts their fall season through November 15 with different hours for weekdays and weekend trips. You can expect a corn maze, pallet maze and fence maze, hayrides, an animal barn, pumpkin bowling, and an 1800s train car! Bring the whole family to the farm in Monroe to get into all of the fall fun.

Carrigan Farms

Carrigan Farms is a Charlotte-area staple for hosting apple picking, pumpkin patches, lake swimming, and their own haunted trail. The Mooresville family farm grows local fruits and vegetables like zucchini, asparagus, and so much more. Reservations are required for pumpkin picking so check their website for more details and reservation information.

Patterson Farm

Located in Mount Ulla, the Patterson Farm Market and Tours team is dedicated to educating people about their food sources while providing fun, hands-on, and interactive teaching opportunities at their farm. Their Pumpkin Patch Tours are recommended for young children, but the whole family can enjoy the other fall activities. Pumpkin Patch Tours, Treasure Mine Adventures, Corn Maize Tours, and geocaching appointments are available through their website. Be sure to check their COVID-19 fact sheet online, too.

Shelby Corn Maze & Pumpkin Patch

The fall fun at Shelby Corn Maze includes an 8-acre corn maze, pumpkin patch, over 40 other attractions, plus a haunted maze! Family entertainment, outdoor fun, and plenty of seasonal snacks are what you can expect at Shelby Corn Maze. Check it out online.

Hunter Farm

No pumpkin patch reservations are required at Hunter Farm this fall. Their fall pumpkin patch is a great place for the whole family to enjoy the thrill of the hunt for the perfect pumpkin! Other farm-friendly activities will include a wagon ride, milk barn, petting barn, and nighttime bonfires and hayrides. Find out more info online.

Wise Acres Organic Farm

Wise Acres Organic Farm puts a new twist on classic fall festivities with a sun hemp maze, a wagon ride through the woods, a wooded fall scavenger hunt, a pumpkin patch, and animals to visit. Enjoy the barrel train and shop for mums, pumpkins, slushies and other seasonal fresh products. Reservations are required.

Friday, October 2, 2020

Rising Home Equity Can Power Your Next Move

Infographic Courtesy of Keeping Current Matters/The KCM Blog

Some Highlights

- According to CoreLogic, homeowners across the country are gaining significant equity.

- Over the past year, the average homeowner gained $9,800 in equity, growing their overall net worth.

- If you’re ready to sell your current house and begin looking for your dream home, contact your local real estate professional to learn how your home equity can help make that possible.

Thursday, October 1, 2020

End of September Update

Activity

in Sun City Carolina Lakes continues to be stong. As of today (9/30/2020) there are only 26 ACTIVE

single family home listings. The numbers

change daily and, as I've mentioned before, one of the main reasons I don't use flyers to share

this information is that flyers are accurate at the time they are

printed and are typically outdated by the time they reach mail tubes. I

hope you'll visit my website regularly for the most current listing

activity and the most current stats for SCCL. If you want to receive

daily updates in your "inbox," just let me know and I'll make that

happen for you.

Home Inventory Determines What Kind of Market We Are In

Months of supply is the measure of how many months it would take for

the current inventory of homes on the market to sell, given the current

pace of home sales. For example, if there are 50 homes on the market and

10 homes selling each month, there is a 5 month supply of homes for

sale.

- Less than 6 months of inventory = Seller's Market with upward pressure on prices

- More than 6 months of inventory = Buyer's Market with downward pressure on prices

With the low number of ACTIVE listings and the increasing number of homes going UNDER CONTRACT, we are currently in a Seller's Market.

The charts below are for the month of August. I will switch them out with September charts as soon as they become available, during the first week of October.

Single Family Homes

Days on Market (DOM)

Follow market activity daily by clicking on "UP-TO-DATE STATS FOR SCCL" tab above.

Also, using the same tab, be sure to scroll down and check out the interactive charts which have the most current stats available through CMLS (through the end of the previous month). Included in those charts are ones that shows "Months Supply of Homes for Sale." There are separate charts for Single Family Homes and Carriage Homes & Villas.