good health, good friends, and

Sound decisions can only be made with accurate and reliable information.

Saturday, December 31, 2022

HAPPY NEW YEAR

good health, good friends, and

Wednesday, December 21, 2022

What To Expect from the Housing Market in 2023

Article Courtesy of Keeping Current Matters/The KCM Blog

The 2022 housing market has been defined by two key things: inflation and rapidly rising mortgage rates. And in many ways, it’s put the market into a reset position.

As the Federal Reserve (the Fed) made moves this year to try to lower inflation, mortgage rates more than doubled – something that’s never happened before in a calendar year. This had a cascading impact on buyer activity, the balance between supply and demand, and ultimately home prices. And as all those things changed, some buyers and sellers put their plans on hold and decided to wait until the market felt a bit more predictable.But what does that mean for next year? What everyone really wants is more stability in the market in 2023. For that to happen we’ll need to see the Fed bring inflation down even more and keep it there. Here’s what housing market experts say we can expect next year.

What’s Ahead for Mortgage Rates in 2023?

Moving forward, experts agree it’s still going to be all about inflation. If inflation is high, mortgage rates will be as well. But if inflation continues to fall, mortgage rates will likely respond. While there may be early signs inflation is easing as we round out this year, we’re not out of the woods just yet. Inflation is still something to watch in 2023.

Right now, experts are factoring all of this into their mortgage rate forecasts for next year. And if we average those forecasts together, experts say we can expect rates to stabilize a bit more in 2023. Whether that’s between 5.5% and 6.5%, it’s hard for experts to say exactly where they’ll land. But based on the average of their projections, a more predictable rate is likely ahead (see chart below):

That means, we’ll start the year out about where we are right now. But we could see rates tick down if inflation continues to drop. As Greg McBride, Chief Financial Analyst at Bankrate, explains:

“. . . mortgage rates could pull back meaningfully next year if inflation pressures ease.”

In the meantime, expect some volatility as rates will likely fluctuate in the weeks ahead. If we see inflation come back under control, that would be good news for the housing market.

What Will Happen to Home Prices Next Year?

Homes prices will always be defined by supply and demand. The more buyers and fewer homes there are on the market, the more home prices will rise. And that’s exactly what we saw during the pandemic.

But this year, things changed. We’ve seen home prices moderate and housing supply grow as buyer demand pulled back due to higher mortgage rates. The level of moderation has varied by local area – with the biggest changes happening in overheated markets. But do experts think that will continue?

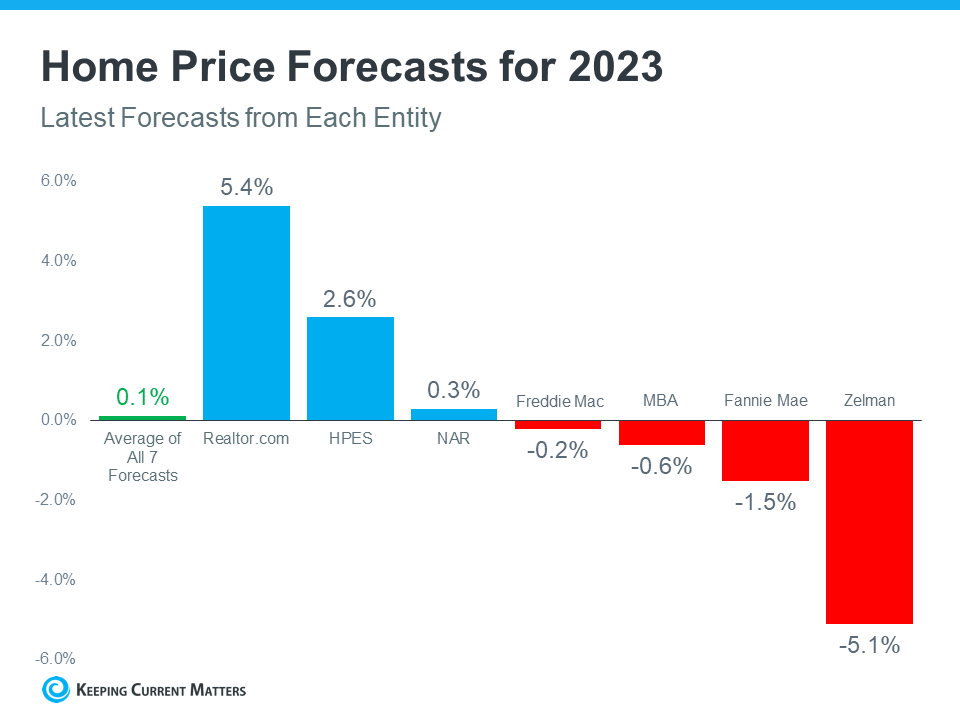

The graph below shows the latest home price forecasts for 2023. As the different colored bars indicate, some experts are saying home prices will appreciate next year, and others are saying home prices will come down. But again, if we take the average of all the forecasts (shown in green), we can get a feel for what 2023 may hold.

The truth is probably somewhere in the middle. That means nationally, we’ll likely see relatively flat or neutral appreciation in 2023. As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“After a big boom over the past two years, there will essentially be no change nationally . . . Half of the country may experience small price gains, while the other half may see slight price declines.”

Bottom Line

The 2023 housing market is going to be defined by mortgage rates, and rates will be determined by what happens with inflation. The best way to keep a pulse on what experts are projecting for next year is to lean on a trusted real estate advisor.

Monday, December 12, 2022

What Every Seller Should Know About Home Prices

Article Courtesy of Keeping Current Matters / The KCM Blog

If you’re trying to decide whether or not to sell your house, recent headlines about home prices may be top of mind. And if those stories have you wondering what that means for your home’s value, here’s what you really need to know.What’s Really Happening with Home Prices?

It’s possible you’ve seen news stories mentioning a drop in home values or home price depreciation, but it’s important to remember those headlines are designed to make a big impression in just a few words. But what headlines aren’t always great at is painting the full picture.

While home prices are down slightly month-over-month in some markets, it’s also true that home values are up nationally on a year-over-year basis. The graph below uses the latest data from S&P Case-Shiller to help tell the story of what’s actually happening in the housing market today:

As the graph shows, it’s true home price growth has moderated in recent months (shown in green) as buyer demand has pulled back in response to higher mortgage rates. This is what the headlines are drawing attention to today.

But what’s important to notice is the bigger, longer-term picture. While home price growth is moderating month-over-month, the percent of appreciation year-over-year is still well above the home price change we saw during more normal years in the market.

The bars for January 2019 through mid-2020 show home price appreciation around 3-4% a year was more typical (see bars for January 2019 through mid-2020). But even the latest data for this year shows prices have still climbed by roughly 10% over last year.

What Does This Mean for Your Home’s Equity?

While you may not be able to capitalize on the 20% appreciation we saw in early 2022, in most markets your home’s value, on average, is up 10% over last year – and a 10% gain is still dramatic compared to a more normal level of appreciation (3-4%).

The big takeaway? Don’t let the headlines get in the way of your plans to sell. Over the past two years alone, you’ve likely gained a substantial amount of equity in your home as home prices climbed. Even though home price moderation will vary by market moving forward, you can still use the boost your equity got to help power your move.

As Mark Fleming, Chief Economist at First American, says:

“Potential home sellers gained significant amounts of equity over the pandemic, so even as affordability-constrained buyer demand spurs price declines in some markets, potential sellers are unlikely to lose all that they have gained.”

Bottom Line

If you have questions about home prices or how much equity you have in your current home, reach out to a local real estate professional for expert advice.

Wednesday, December 7, 2022

Key Advantages of Buying a Home Today

Article Courtesy of Keeping Current Matters / The KCM Blog

There’s no doubt buying a home today is different than it was over the past couple of years, and the shift in the market has led to advantages for buyers today. Right now, there are specific reasons that make this housing market attractive for those who’ve thought about buying but have sidelined their search due to rising mortgage rates.Buying a home in any market is a personal decision, and the best way to make that decision is to educate yourself on the facts, not following sensationalized headlines in the news today. The reality is, headlines do more to terrify people thinking about buying a home than they do to clarify what’s actually going on with real estate.

Here are three reasons potential home buyers should consider buying a home today.

1. More Homes Are for Sale Right Now

According to data from the National Association of Realtors (NAR), this year, the supply of homes for sale has grown significantly compared to where we started the year (see graph below):

This growth has happened for two reasons: homeowners listing their homes for sale and homes staying on the market a bit longer as buyer demand has moderated in response to higher mortgage rates.

The good news for you is that more inventory means more homes to choose from. And when there are more homes on the market, you could also see less competition from other buyers because the peak frenzy of competing over the same home has eased too.

2. Home Prices Are Not Projected To Crash

Experts don’t believe home prices will crash like they did in 2008. Instead, home prices will moderate at various levels depending on the local market and the factors, like supply and demand, at play in that area. That’s why some experts are calling for slight appreciation and others are calling for slight depreciation (see graph below):

3. Mortgage Rates Have Risen, but They Will Come Down

While mortgage rates have risen dramatically this year, the rapid increases we’ve seen have moderated in recent weeks as early signs hint that inflation may be easing slightly. Where they’ll go from here largely depends on what happens next with inflation. If inflation does truly begin to cool, mortgage rates may come down as a result.

When that happens, expect more buyers to jump back into the market. For you, that means you’ll once again face more competition. Buying your house now before more buyers reenter the market could help you get one step ahead. As Lawrence Yun, Chief Economist for NAR, says:

“The upcoming months should see a return of buyers, as mortgage rates appear to have already peaked and have been coming down since mid-November.”

When mortgage rates come down, those waiting on the sidelines will jump back in. Your advantage is getting in before they do.

Bottom Line

If you’re thinking about buying a home, you should seriously consider the advantages today’s market offers. Connecting with a local real estate professional may be the best next move so you can make the dream of homeownership a reality.

Monday, December 5, 2022

Prioritizing Your Wants and Needs as a Homebuyer in Today’s Market

Article Courtesy of Keeping Current Matters / The KCM Blog

There’s no denying mortgage rates are higher now than they were last year. And if you’re thinking about buying a home, this may be top of mind for you. That’s because those higher rates impact how much it costs to borrow money for your home loan. As you set out to make a purchase this winter, you’ll need to be strategic so you can find a home that meets your needs and budget.Danielle Hale, Chief Economist at realtor.com, explains:

“The key to making a good decision in this challenging housing market is to be laser focused on what you need now and in the years ahead, . . . Another key point is to avoid stretching your budget, as tempting as it may be given the diminished purchasing power.”

In other words, it’s important to be mindful of what’s a necessity and what’s a nice-to-have when searching for a home. And the best way to understand this is to put together a list of desired features for your home search.

The first step? Get pre-approved for a mortgage. Pre-approval helps you better understand what you can borrow for your home loan, and that plays an important role in how you’ll craft your list. After all, you don’t want to fall in love with a home that’s out of reach. Once you have a good grasp of your budget, you can begin to list (and prioritize) all the features of a home you would like.

Here’s a great way to think about them before you begin:

- Must-Haves – If a house doesn’t have these features, it won’t work for you and your lifestyle (examples: distance from work or loved ones, number of bedrooms/bathrooms, etc.).

- Nice-To-Haves – These are features that you’d love to have but can live without. Nice-To-Haves aren’t dealbreakers, but if you find a home that hits all the must-haves and some of the these, it’s a contender (examples: a second home office, a garage, etc.).

- Dream State – This is where you can really think big. Again, these aren’t features you’ll need, but if you find a home in your budget that has all the must-haves, most of the nice-to-haves, and any of these, it’s a clear winner (examples: farmhouse sink, multiple walk-in closets, etc.).

Finally, once you’ve created your list and categorized it in a way that works for you, discuss it with your real estate advisor. They’ll be able to help you refine the list further, coach you through the best way to stick to it, and find a home in your area that meets your needs.

Bottom Line

Putting together your list of necessary features for your next home might seem like a small task, but it’s a crucial first step on your homebuying journey today. If you’re ready to find a home that fits your needs, connect with a local real estate advisor.

Saturday, December 3, 2022

Winter Home Selling Checklist [INFOGRAPHIC]

Infographic Courtesy of Keeping Current Matters/The KCM Blog

Some Highlights

- As you get ready to sell your house, focus on tasks that make it inviting, show it’s cared for, and boost your curb appeal.

- This list will help you get started, but don’t forget, a real estate professional will provide other helpful tips based on your specific situation.

- Connect with a trusted real estate professional for advice on what you may want to do to get your house ready to sell this season.