What a strange year it has been. As we look at 2020 in the rear-view mirror, we look ahead to a year of promise and exciting expectation for returning to life before the COVID-19 pandemic. While so many have suffered greatly from personal loss of family and friends, failing businesses, confinement, and adjusting to a world of masks, Zoom meetings, children young and old dealing with virtual education, and lack of personal connections, we continue to persevere and keep our eyes on the light at the end of the tunnel. I am personally grateful that I am one of the fortunate ones who, despite inconveniences and lack of personal contact with loved ones and dear friends, have made it through relatively well. I have enjoyed daily walks with our dog, Rudy, which provided me with the opportunity to meet safely with many people (and pets) along the walkways and trails of our beautiful community. I have also been able to work with clients, albeit under very restricted conditions. Masks, gloves, and hand sanitizer have become part of my business life, but have allowed me to help people purchase and sell homes in these unusual times. As we head into the new year, I look forward to (at some point) getting back to more normal personal and business routines. I look forward to spending time with family, friends, and clients, and, as president of our Grey Hawk neighborhood, I look forward to seeing my neighbors again at events that have been put on hold for way too long. So, as we move into 2021, I wish you a year filled with all the pleasures that you missed in 2020! Stay strong. Stay safe. Stay healthy. And know that, as always, I am here for you.

Sound decisions can only be made with accurate and reliable information.

Thursday, December 31, 2020

Why Selling Your House on Your Own in 2021 Is a Mistake

Article Courtesy of Keeping Current Matters/The KCM Blog

There are many benefits to working with a real estate professional when selling your house. During challenging times, like what we face today, it becomes even more important to have an expert you trust to help guide you through the process. If you’re considering selling on your own, known in the industry as a For Sale By Owner (FSBO), it’s critical to consider the following items.

1. Your Safety Is a Priority

Your safety should always come first, and that’s more crucial than ever given the current health situation in our country. When you FSBO, it is incredibly difficult to control entry into your home. A real estate professional will have the proper protocols in place to protect not only your belongings but your health and well-being too. From regulating the number of people in your home at one time to ensuring proper sanitization during and after a showing, and even facilitating virtual tours, real estate professionals are equipped to follow the latest industry standards recommended by the National Association of Realtors (NAR) to help protect you and your potential buyers.

2. A Powerful Online Strategy Is a Must to Attract a Buyer

Recent studies from NAR have shown that, even before COVID-19, the first step 43% of all buyers took when looking for a home was to search online. Throughout the process, that number jumps to 97%. Today, those numbers have grown exponentially. Most real estate agents have developed a strong Internet and social media strategy to promote the sale of your house.

3. There Are Too Many Negotiations

Here are just a few of the people you’ll need to negotiate with if you decide to FSBO:

- The buyer, who wants the best deal possible

- The buyer’s agent, who solely represents the best interest of the buyer

- The inspection company, which works for the buyer and will almost always find challenges with the house

- The appraiser, if there is a question of value

As part of their training, agents are taught how to negotiate every aspect of the real estate transaction and how to mediate the emotions felt by buyers looking to make what is probably the largest purchase of their lives.

4. You Won’t Know if Your Purchaser Is Qualified for a Mortgage

Having a buyer who wants to purchase your house is the first step. Making sure they can afford to buy it is just as important. As a FSBO, it’s almost impossible to be involved in the mortgage process of your buyer. A real estate professional is trained to ask the appropriate questions and, in most cases, will be intimately aware of the progress being made toward a purchaser’s mortgage commitment. You need someone who’s working with lenders every day to guarantee your buyer makes it to the closing table.

5. FSBOing Is Becoming More Difficult from a Legal Standpoint

The documentation involved in the selling process is growing dramatically as more and more disclosures and regulations become mandatory. In an increasingly litigious society, the agent acts as a third-party to help the seller avoid legal jeopardy. This is one of the major reasons why the percentage of people FSBOing has dropped from 19% to 8% over the last 20+ years.

6. You Net More Money When Using an Agent

Many homeowners think they’ll save the real estate commission by selling on their own. Realize that the main reason buyers look at FSBOs is because they also believe they can save the real estate agent’s commission. The seller and buyer can’t both save on the commission.

A study by Collateral Analytics revealed that FSBOs don’t actually save anything by forgoing the help of an agent. In some cases, the seller may even net less money from the sale. The study found the difference in price between a FSBO and an agent-listed home was an average of 6%. One of the main reasons for the price difference is effective exposure:

“Properties listed with a broker that is a member of the local MLS will be listed online with all other participating broker websites, marketing the home to a much larger buyer population. And those MLS properties generally offer compensation to agents who represent buyers, incentivizing them to show and sell the property and again potentially enlarging the buyer pool.”

The more buyers that view a home, the greater the chance a bidding war will take place, potentially driving the price higher, too.

Bottom Line

Listing on your own leaves you to manage the entire transaction by yourself. Why do that when you can hire an agent and still net the same amount of money? Before you decide to take on the challenge of selling your house alone, reach out to a local real estate professional to discuss your options.

Monday, December 21, 2020

The Do’s and Don’ts after Applying for a Mortgage

Below is a list of things you shouldn’t do after applying for a mortgage. They’re all important to know – or simply just good reminders – for the process.

1. Don’t Deposit Cash into Your Bank Accounts Before Speaking with Your Bank or Lender. Lenders need to source your money, and cash is not easily traceable. Before you deposit any amount of cash into your accounts, discuss the proper way to document your transactions with your loan officer.

2. Don’t Make Any Large Purchases Like a New Car or Furniture for Your New Home. New debt comes with new monthly obligations. New obligations create new qualifications. People with new debt have higher debt-to-income ratios. Higher ratios make for riskier loans, and then sometimes qualified borrowers no longer qualify.

3. Don’t Co-Sign Other Loans for Anyone. When you co-sign, you’re obligated. With that obligation comes higher ratios as well. Even if you promise you won’t be the one making the payments, your lender will have to count the payments against you.

4. Don’t Change Bank Accounts. Remember, lenders need to source and track your assets. That task is significantly easier when there’s consistency among your accounts. Before you transfer any money, speak with your loan officer.

5. Don’t Apply for New Credit. It doesn’t matter whether it’s a new credit card or a new car. When you have your credit report run by organizations in multiple financial channels (mortgage, credit card, auto, etc.), your FICO® score will be impacted. Lower credit scores can determine your interest rate and maybe even your eligibility for approval.

6. Don’t Close Any Credit Accounts. Many buyers believe having less available credit makes them less risky and more likely to be approved. Wrong. A major component of your score is your length and depth of credit history (as opposed to just your payment history) and your total usage of credit as a percentage of available credit. Closing accounts has a negative impact on both of those determinants of your score.

Bottom Line

Any blip in income, assets, or credit should be reviewed and executed in a way that ensures your home loan can still be approved. If your job or employment status has changed recently, share that with your lender as well. The best plan is to fully disclose and discuss your intentions with your loan officer before you do anything financial in nature.

Friday, December 18, 2020

2021 Housing Forecast [INFOGRAPHIC]

- Experts project an optimistic year for the 2021 housing market.

- With mortgage rates forecasted to remain low, high buyer demand is expected to fuel more home sales and continue to increase home prices.

- Reach out to a local real estate professional today to determine how to make your best move in the new year.

Friday, December 11, 2020

South Carolina Homestead Exemption

HOMESTEAD EXEMPTION

SC Department of Revenue Information on Homestead Exemption:

https://dor.sc.gov/lgs/homestead-exemption

The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally and permanently disabled, or legally blind.

To qualify for a Homestead Exemption, you must be a legal resident of South Carolina for at least one year on or before December 31 of the year prior to the exemption.

Example: If you become a resident between January 1 and December 31, 2020, you will qualify in 2022. If you become a resident in January 2021, you will not qualify until 2023.

You must apply for the Homestead Exemption at your County Auditor's office. If you are unable to go to the Auditor's office, you may authorize someone to apply for you.

Lancaster County SC website > Departments > Auditor > Online forms > Homestead Exemption

Thursday, December 10, 2020

Wishing You a Joyous Holiday Season

From my family to yours,

Best wishes for a joyous holiday season

and a New Year blessed

with good health, good friends, and good times.

Pook

Tuesday, November 24, 2020

Is Buying a Home Today a Good Financial Move?

Article Courtesy of Keeping Current Matters/The KCM Blog

There’s no doubt 2020 has been a challenging year. A global pandemic coupled with an economic recession has caused heartache for many. However, it has also prompted more Americans to reconsider the meaning of “home.” This quest for a place better equipped to fulfill our needs, along with record-low mortgage rates, has skyrocketed the demand for home purchases.

This increase in demand, on top of the severe shortage of homes for sale, has also caused more bidding wars and thus has home prices appreciating rather dramatically. Some, therefore, have become cautious about buying a home right now.

The truth of the matter is, even though homes have appreciated by a whopping 6.7% over the last twelve months, the cost to buy a home has actually dropped. This is largely due to mortgage rates falling by a full percentage point.

Let’s take a look at the monthly mortgage payment on a $300,000 house one year ago, and then compare it with that same home today, after it has appreciated by 6.7% to $320,100:

Compared to this time last year, you’ll actually save $87 dollars a month by purchasing that home today, which equates to over one thousand dollars a year.

But isn’t the economy still in a recession?

Yes, it is. That, however, may make it the perfect time to buy your first home or move up to a larger one. Tom Gil, a Harvard trained negotiator and real estate investor, recently explained:

“When volatile assets are facing recessions, hard assets, such as gold and real estate, thrive. Historically speaking, residential real estate has done better compared to other markets during and after recessions.”

That thought is substantiated by the fact that homeowners have 40 times the net worth of renters. Odeta Kushi, Deputy Chief Economist for First American Financial Corporation, recently said:

“Despite the risk of volatility in the housing market, numerous studies have demonstrated that homeownership leads to greater wealth accumulation when compared with renting. Renters don’t capture the wealth generated by house price appreciation, nor do they benefit from the equity gains generated by monthly mortgage payments, which become a form of forced savings for homeowners.”

Bottom Line

With home prices still increasing and mortgage rates perhaps poised to begin rising as well, buying your first home, or moving up to a home that better fits your current needs, likely makes a ton of sense.

Monday, November 23, 2020

Happy Thanksgiving 2020

Wednesday, November 18, 2020

NOVEMBER MID-MONTH UPDATE

It's been a whiplash kind of month here at SCCL, as the number of ACTIVE listings continue to change almost daily... sometimes several times a day. October ended with 15 ACTIVE Single Family Residence (SFR) listings and dropped down to 14, 13, and then only 9 on November 10, with 7 UNDER CONTRACT. On November 15th, there were 11 ACTIVE SFR listings, with 11 UNDER CONTRACT for the month. November 17th there were 11 ACTIVE, 13 UNDER CONTRACT, and 13 CLOSED SFR listings. Carriage Homes and Villas (CHV) showed more than usual activity, also. While there were 5 ACTIVE CHV listings at the end of October, on November 17th, ACTIVE listings were down to two.

The holiday season is quickly approaching, with Thanksgiving only a week away. Will sales slow down during the holidays? No one can say for sure, but, last year 9 SFRs and 2 CHVs went UNDER CONTRACT in December. Typically, folks who look at homes during the holiday season are serious about purchasing. Many times out-of-town house guests are so impressed with Sun City Carolina Lakes that they decide to move here. This year, with the limitations we face due to the COVID pandemic, that might not happen this year... but, it certainly hasn't slowed activity down over recent months, so who knows? This might just be a very active holiday season.

If you're thinking about selling or moving, or have friends or family that are contemplating a move, please contact me. I'd love to discuss your plans and your options with you. As many who decide to move have said, "If not now, when?"

Tuesday, November 17, 2020

3 Graphs That Prove We’re Not Headed for a Foreclosure Crisis

Article Courtesy of Keeping Current Matters/The KCM Blog

We all know the saying about assumptions.

And if you don’t, well…just Google it.

With the massive surge of unemployment that happened this year, it’s natural to assume that a massive surge of foreclosures will follow.

However, history is not expected to repeat itself this time.

Here are 3 simple graphs that prove why we’re not headed for another foreclosure crisis.

The unique conditions that led to the 2008 market collapse and foreclosure crisis were in big part due to cashed-out equity. With many borrowers owing more than they could afford on their homes, mass foreclosures followed.

Today’s market, however, looks a lot different. Instead, homeowners have an abundance of equity, and lending standards are much stricter. This means that instead of foreclosing and walking away, many homeowners are in a good position to protect their investment.

Looking at this graph, we can see that of those who requested forbearance, nearly 44% have either paid off their mortgage or opted out. It also shows that of all the homeowners in forbearance, only 80,000 are at risk of moving into foreclosures.

To drive this point home, Mike Fratantoni, Senior Vice President and Chief Economist at the Mortgage Bankers Association (MBA), said:

“Nearly two-thirds of borrowers who exited forbearance remained current on their payments, repaid their forborne payments, or moved into a payment deferral plan. All of these borrowers have been able to resume – or continue – their pre-pandemic monthly payments.”

After the 2008 financial collapse, we saw the worst foreclosure crises in history. The market was flooded with homes that had defaulted on their mortgage payments, spiking all the way up to over 500,000 at the peak in 2009.

Today, we are looking at a much different story. According to Black Knight, 91% of homeowners in forbearance have 11% equity in their homes. While that may not seem like a big number, that much equity means rather than foreclose, those homeowners can not only sell their homes but walk away with gains from it.

According to Odeta Kushi, economist for First American:

“Economic distress and a lack of equity are the two triggers of a foreclosure. Each trigger by itself is necessary, but not sufficient for foreclosure. The percentage of economically distressed homeowner households is highest in COVID-19 hotspots… However, the equity built up since the Great Recession can provide an important buffer for distressed homeowners.”

The big question is: what happens when forbearance inevitably expires? Many lenders are offering to help homeowners create a plan for the deferred payments. There are multiple options that homeowners can pursue at this point, and with the right planning and communication with their lender, they may be able to avoid foreclosure, especially if they have equity in their homes.

Bottom Line

The reality of the situation is this: through all of the hardship Americans have faced this year, people are going to fall into foreclosure.

However, the last thing anyone wants right now is another foreclosure crisis like 2008, and there are many factors that suggest it’s not going to be like last time.

By educating your clients with data and insights from market experts, you can help them make smart and calculated real estate decisions instead of those based on scary headlines or hearsay.

Anyone can drive a car really fast in a straight line. It’s those that can navigate the twists and turns that cross the finish line first.

That’s why we’ve put together the How to Succeed in a Changing Market eGuide. This free resource tells you everything you need to know about navigating a changing market so you can be the real estate agent your clients trust-especially when times are tough.

Monday, November 16, 2020

$1000 Veteran Credit

Thanks to Melissa Messick of Movement Mortgage for the following information.

Beginning 11/11/2020 any loan (including refinancing) submitted as a VA home loan will receive a $1000 credit towards closing cost. Eligible Borrowers include any current or past member of the armed services, including surviving spouses as defined by the Veterans Administration. This special will apply to any loan submitted between 11/11/2020 and 1/11/2021. Please call me for more details.

Melissa Messick| SENIOR LOAN OFFICE / NMLS 97916

Office (980) 777-1042

Mobile (704) 905-4009

Melissa.Messick@movement.com

For information about V.A. Loans, click HERE.

Wednesday, November 11, 2020

VETERANS DAY 2020

It is

with grateful appreciation that we give heartfelt thanks to the men and

women who have served in our armed forces, protecting our nation, and

preserving the freedoms we cherish.

It is

with grateful appreciation that we give heartfelt thanks to the men and

women who have served in our armed forces, protecting our nation, and

preserving the freedoms we cherish.

When those of us now

referred to as "seniors" were young, we celebrated "Armistice Day" to

recognize the signing of the Armistice that ended World War I and to

honor those who bravely served and those who made the ultimate sacrifice

on foreign soil. The main hostilities of WWI were properly finished 102 years ago

at the 11th hour of the 11th day of the 11th month of 1918, with

Germany signing the Armistice. Red poppies were distributed by members

of the American Legion Auxillary, as a remembrance of the sacrifices of those who served during the war.

The

symbolism of the red poppy began with the poem IN FLANDERS FIELDS,

penned by Lieutenant Colonel John McCrae, MD (1872-1918) of the Canadian

Army, after presiding over the funeral of a friend and fellow soldier

and being moved by the poppy flowers that grew in the Flanders

battlefields on the southeast edge of the town of Waregem, Belgium. The

imagery created by that poem remains an important symbol of the

sacrifices of war today. On June 1,1954, Armistice Day was changed to

Veterans Day to honor all U.S. veterans.

The

symbolism of the red poppy began with the poem IN FLANDERS FIELDS,

penned by Lieutenant Colonel John McCrae, MD (1872-1918) of the Canadian

Army, after presiding over the funeral of a friend and fellow soldier

and being moved by the poppy flowers that grew in the Flanders

battlefields on the southeast edge of the town of Waregem, Belgium. The

imagery created by that poem remains an important symbol of the

sacrifices of war today. On June 1,1954, Armistice Day was changed to

Veterans Day to honor all U.S. veterans.

|

| Beautiful tribute to our Veterans by Richard Kerry Thompson. YOU RAISE ME UP |

|

| Lovely rendition honoring our Veterans of HALLELUJAH by Sailor Jerri. |

Tuesday, November 10, 2020

HAPPY 245TH BIRTHDAY TO THE UNITED STATES MARINE CORPS

Each year it is my honor and privilege to offer birthday greetings and a heartfelt thank you to my husband and his special Marine Corps brothers and to all who wear or have worn the globe and anchor. Once a Marine, always a Marine. The Few. The Proud. Semper Fi.

Source: http://www.usmcpress.com/heritage/usmc_heritage.htm

Since those earliest days when the "Continental Marines" fought for our country's independence at sea and on shore, the United States Marine Corps has responded to conflicts around the world, participating in combat operations and humanitarian relief efforts by air, land, and sea. Mandated by Congress to be our county's rapid response force, the United State Marine Corps has proudly served our country for 244 years. From the shores of Tripoli to Guadalcanal and Iwo Jima, Korea, the jungles of Vietnam, the mountains of Afghanistan, the Iraqi desert, and all the operations in-between, Marines from all walks of life have defended our nation.

Each year on November 10th, Marines around the world live up to the motto "Semper Fidelis" (Always Faithful) as they celebrate the birth of the Corps. Whether attending a formal Marine Corps Ball or a small informal gathering, or even with just a phone call or a handshake, those who share the bond of being one of "The Few. The Proud." proudly honor the values, traditions, and history of the Corps on this day by wishing each other a Happy Birthday.

Each year Bob Parsons, founder of Go-Daddy, shares his love for "Mother Green" by presenting a birthday video to honor the United States Marine Corps. Here is a link to this year's video: 2020 USMC VIDEOAdditionally, each year the Bob & Renee Parsons Foundation partners with the Semper Fi fund to raise funds to provide financial support for wounded, critically ill, and injured members of all branches of the U.S. Armed Forces. Last year, they raised more than $20 million dollars. Again this year, the Foundation will match donations dollar-for-dollar up to $10 million dollars.

To donate, please visit: SemperFiFund.org/match

On a personal note...

SEMPER FI!

Thursday, November 5, 2020

Celebrating Thanksgiving Safely

CDC's General considerations for fall and winter holidays

People who should not attend in-person holiday celebrations

People with or exposed to COVID-19

Do not host or participate in any in-person festivities if you or anyone in your household:

- Has been diagnosed with COVID-19 and has not met the criteria for when it is safe to be around others

- Has symptoms of COVID-19

- Is waiting for COVID-19 viral test results

- May have been exposed to someone with COVID-19 in the last 14 days

- Is at increased risk of severe illness from COVID-19

People at increased risk for severe illness

If you are at increased risk of severe illness from COVID-19, or live or

work with someone at increased risk of severe illness, you should:

- Avoid in-person gatherings with people who do not live in your household.

- Avoid larger gatherings and consider attending activities that pose lower risk (as described throughout this page) if you decide to attend an in-person gathering with people who do not live in your household.

Thanksgiving

Thanksgiving is a time when many families travel long distances to celebrate together. Travel increases the chance of getting and spreading the virus that causes COVID-19. Staying home is the best way to protect yourself and others. If you must travel, be informed of the risks involved.

Lower risk activities

- Having a small dinner with only people who live in your household

- Preparing traditional family recipes for family and neighbors, especially those at higher risk of severe illness from COVID-19, and delivering them in a way that doesn’t involve contact with others

- Having a virtual dinner and sharing recipes with friends and family

- Shopping online rather than in person on the day after Thanksgiving or the next Monday

- Watching sports events, parades, and movies from home

Moderate risk activities

- Having a small outdoor dinner with family and friends who live in your community

- Lower your risk by following CDC’s recommendations on hosting gatherings or cook-outs.

- Visiting pumpkin patches or orchards where people use hand sanitizer before touching pumpkins or picking apples, wearing masks is encouraged or enforced, and people are able to maintain social distancing

- Attending a small outdoor sports events with safety precautions in place

Higher risk activities

Avoid these higher risk activities to help prevent the spread of the virus that causes COVID-19:

- Going shopping in crowded stores just before, on, or after Thanksgiving

- Participating or being a spectator at a crowded race

- Attending crowded parades

- Using alcohol or drugs, which can cloud judgement and increase risky behaviors

- Attending large indoor gatherings with people from outside of your household

More Information

Friday, October 30, 2020

Monday, October 26, 2020

Two Important Impacts of Home Equity

Article Courtesy of Keeping Current Matters/The KCM Blog

Equity continues to rise, helping American homeowners secure a much more stable financial future. According to the most recent data from CoreLogic, the average homeowner gained $9,800 in equity over the past year. In addition, experts project 2020 home prices to continue rising. With prices going up, equity gains will also keep accelerating. Black Knight just reported:“The annual percent change in the overall median existing single-family-home price has skyrocketed in the past several months, with recent numbers at three to five times higher than rates seen in the past several years.”

Jeff Tucker, Senior Economist at Zillow, just qualified recent price increases as “jaw-dropping” and “within a hair’s breadth of double-digit year-over-year appreciation.”

Knowing equity will help enable many homeowners to better survive the economic distress caused by the ongoing pandemic, it’s important to break down two key homeowner benefits of increasing equity.

1. Equity Increases a Homeowner’s Options to Buy a New Home

Aside from the financial damage of the last seven months, there has also been a tremendous emotional toll on many people. Shelter-in-place mandates, quarantine requirements, and virtual schooling have all made us re-evaluate the must-have requirements a home should deliver. Having equity in your current house gives you a better opportunity to move-up or build your perfect home from scratch.

Mark Fleming, Chief Economist at First American, recently explained:

“As homeowners gain equity in their homes, they are more likely to consider using that equity to purchase a larger or more attractive home – the wealth effect of rising equity.”

If you need to make a move, the equity in your current home can help make that possible – right now.

2. Equity Enables Homeowners to Help Future Generations

An increase in home equity grows overall wealth, which can transfer to future generations. The Federal Reserve, in an addendum to their recent Survey of Consumer Finances, explains:

“There are numerous ways families can transmit wealth and resources across generations. Families can directly transfer their wealth to the next generation in the form of a bequest. They can also provide the next generation with inter vivos transfers (gifts), for example, providing down payment support to enable a home purchase or a substantial wedding gift.”

The Federal Reserve also explains another way wealth (including the additional net worth generated by an increase in home equity) can benefit future generations:

“In addition to direct transfers or gifts, families can make investments in their children that indirectly increase their wealth. For example, families can invest in their children’s educational success by paying for college or private schools, which can in turn increase their children’s ability to accumulate wealth.”

Bottom Line

Equity can help a homeowner grow their confidence in a more stable financial future. It provides near-term move-up options and creates a positive impact for future generations. In many cases, the largest single investment a person has is their home. As that investment appreciates in value, financial options increase too.

Tuesday, October 20, 2020

October Mid-Month Update

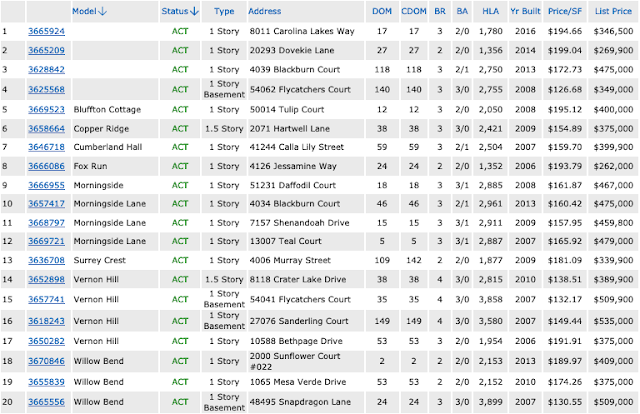

Activity in Sun City Carolina Lakes continues to be strong. As of today (10/19/2020) there are only 20 ACTIVE single family home listings and 6 Carriage Home/Villa listings. The numbers change daily and, as I've mentioned before, one of the main reasons I don't use flyers to share this information is that flyers are accurate at the time they are printed and are typically outdated by the time they reach mail tubes. I hope you'll visit my website regularly for the most current listing activity and the most current stats for SCCL. If you want to receive daily updates in your "inbox," just let me know and I'll make that happen for you.

Currently ACTIVE Listings

Single Family Residences

To date, 14 Single Family homes and one Villa have gone UNDER CONTRACT this month.

Check out the Days on Market (DOM) to see how many days it took for these properties to go under contract from the day they became ACTIVE listings. Note that CDOM indicates that a property was listed more than once and shows a total for both listings.

Friday, October 16, 2020

How to Prepare for a Bidding War [INFOGRAPHIC]

Infographic Courtesy of Keeping Current Matters / The KCM blog

Some Highlights

- With so few houses available on the market today, being ready for a bidding war is essential for prospective homebuyers.

- From pre-approval to making your best offer, here are three tips to make sure you can act quickly and confidently when you find the perfect home.

- Reach out to a trusted real estate professional today to be sure you have the guidance you need as the competition for homes heats up this season.

Wednesday, October 14, 2020

Record-High Lumber Costs Drive Up New-Home Prices

Shoppers seeking newly constructed homes are facing sharply increased prices as the cost of lumber has soared to record highs. Many buyers are finding themselves priced out of the new-home market, builders say.

Recent price spikes in lumber have added more than $16,000 to the typical cost of a new single-family home. The multifamily sector is also feeling the impact, with the typical apartment seeing an increase of more than $6,000, according to data from the National Association of Home Builders.

The increase has priced more than 2.1 million U.S. households out of the market for a median-priced new home, according to the NAHB.

Average lumber prices have increased by more than 170% since mid-April. They’ve reached a record high of more than $800 per 1,000 board feet, a common industry measure. Builders are advocating for lawmakers to take action to increase the supply and reduce the cost of lumber, saying lumber shortages could stress the housing market beyond its current state if too many buyers become priced out of the new-home market.

“Residential construction can lead the nation out of its current economic downturn, as it has during virtually every major economic disruption over the past five decades,” writes Chuck Fowke, NAHB’s 2020 chairman, in a column at BuilderOnline. “But it is vital that elected officials support policies that help America’s home builders gain access to reasonably priced building materials, particularly lumber.”