Be Thankful You Don't Have to Pay Your Parents' Interest Rate!

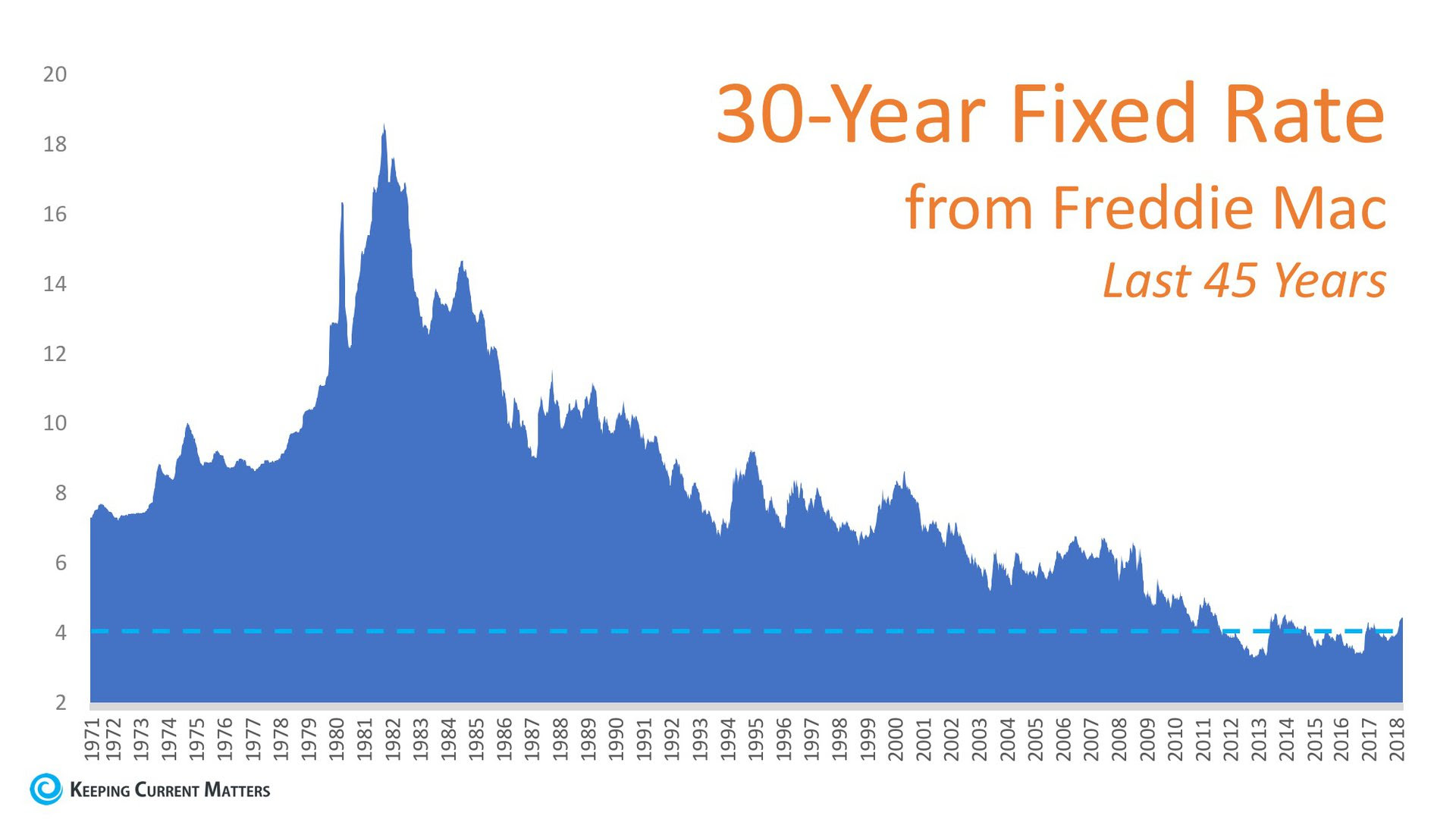

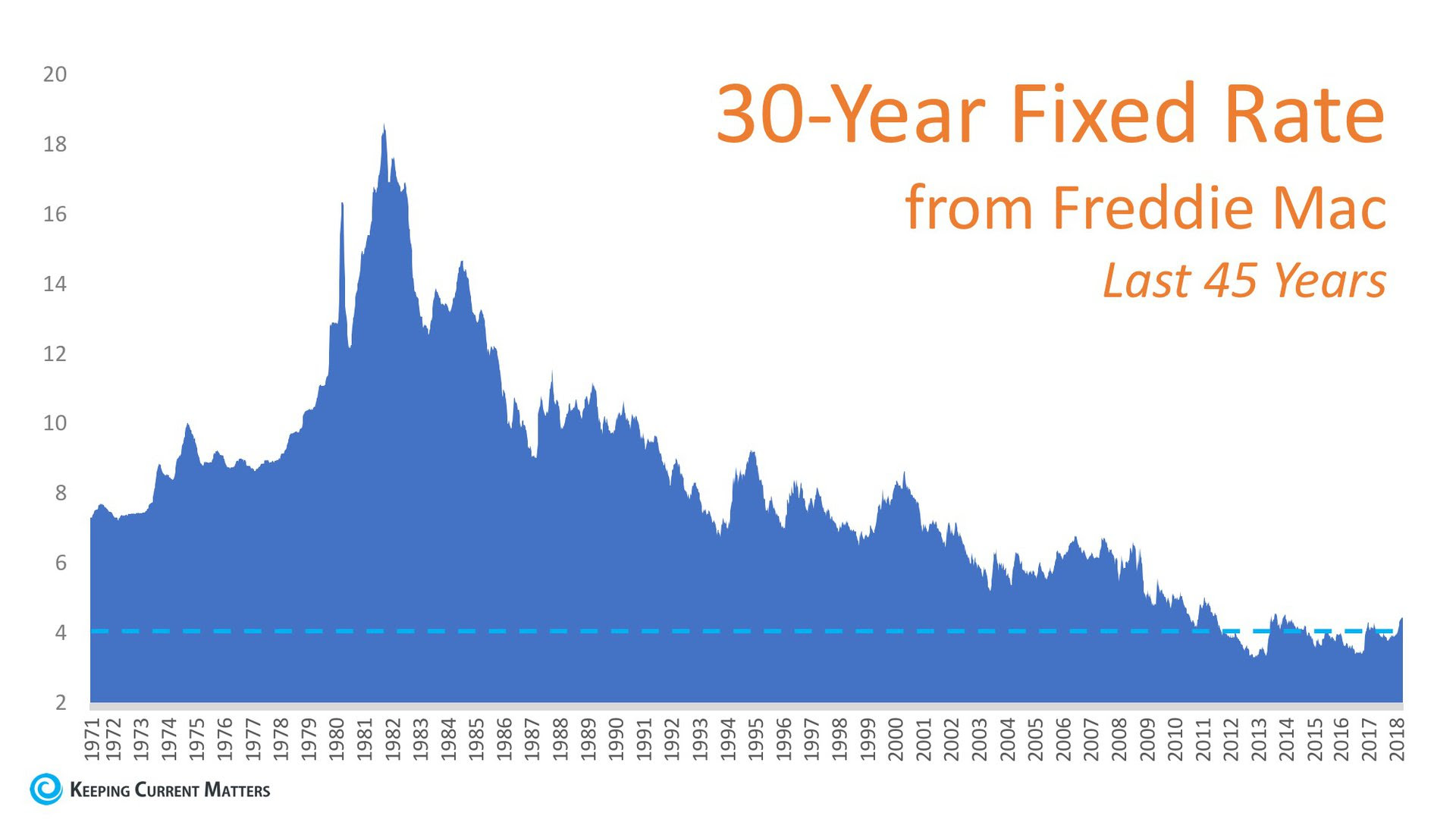

Here's a great message for those concerned over rising interest rates... especially those younger first-time home buyers. Granted, even small increases will affect your monthly payment and that's what is most important when you're analyzing how much of a home you can afford. So, as interest rates start going up, moving ahead with making a purchase sooner, rather than later, is a prudent move, if you are in a position to do so. That being said, this article gives a great perspective on interest rates over the past 45 years.

Article Courtesy of Keeping Current Matters/The KCM Blog

3/28/18

Be Thankful You Don't Have to Pay Your Parents' Interest Rate!

Article Courtesy of Keeping Current Matters/The KCM Blog

3/28/18

Be Thankful You Don't Have to Pay Your Parents' Interest Rate!

Interest

rates hovered around 4% for the majority of 2017, which gave many

buyers relief from rising home prices and helped with affordability. In

the first quarter of 2018, rates have increased from 3.95% up to 4.45%

and experts predict that rates will increase even more by the end of the

year.

Interest

rates hovered around 4% for the majority of 2017, which gave many

buyers relief from rising home prices and helped with affordability. In

the first quarter of 2018, rates have increased from 3.95% up to 4.45%

and experts predict that rates will increase even more by the end of the

year.

The rate you secure greatly impacts your monthly mortgage payment and

the amount you will ultimately pay for your home. Don’t let the

prediction that rates will increase stop you from purchasing your dream

home this year.

Let’s take a look at a historical view of interest rates over the last 45 years.

Bottom Line

Be thankful that you can still get a better interest rate than your

older brother or sister did ten years ago, a lower rate than your

parents did twenty years ago, and a better rate than your grandparents

did forty years ago.

Article Courtesy of Keeping Current Matters/The KCM Blog

Article Courtesy of Keeping Current Matters/The KCM Blog Interest

rates hovered around 4% for the majority of 2017, which gave many

buyers relief from rising home prices and helped with affordability. In

the first quarter of 2018, rates have increased from 3.95% up to 4.45%

and experts predict that rates will increase even more by the end of the

year.

Interest

rates hovered around 4% for the majority of 2017, which gave many

buyers relief from rising home prices and helped with affordability. In

the first quarter of 2018, rates have increased from 3.95% up to 4.45%

and experts predict that rates will increase even more by the end of the

year.

No comments:

Post a Comment